BMW 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

34

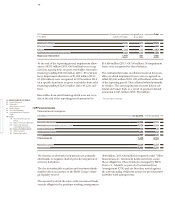

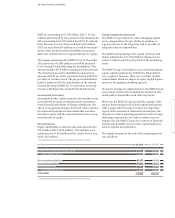

At 31 December 2014 common stock issued by BMW AG

was divided, as at the end of the previous year, into

601,995,196 shares of common stock with a par-value of

€ 1. Preferred stock issued by BMW AG was divided into

54,499,544 shares (2013: 54,259,787 shares) with a par-

value of € 1. Unlike the common stock, no voting rights

are attached to the preferred stock. All of the Company’s

stock is issued to bearer. Preferred stock bears an addi-

tional dividend of € 0.02 per share.

In 2014, a total of 239,777 shares of preferred stock was

sold to employees at a reduced price of € 37.08 per share

in conjunction with the Company’s Employee Share

Programme. These shares are entitled to receive divi-

dends with effect from the financial year 2015. 20 shares

of preferred stock were bought back via the stock

ex-

change

in conjunction with the Company’s Employee

Share

Programme.

Further information on share-based remuneration is

provided in note 20.

Issued share capital increased by € 0.2 million as a re-

sult of the issue to employees of 239,757 shares of non-

voting preferred stock. The number of authorised shares

and the Authorised Capital of BMW AG amounted to

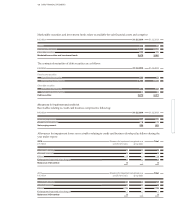

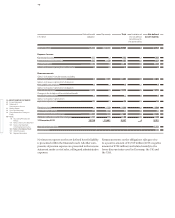

Cash and cash equivalents

Cash and cash equivalents of € 7,688 million (

2013*

:

€ 7,671 million) comprise cash on hand and at bank, all

Receivables that are overdue by between one and

30 days do not normally result in bad debt losses since

the overdue nature of the receivables is primarily at-

tributable to the timing of receipts around the month-

4.8 million shares and € 4.8 million respectively at the

end of the reporting period. The Company is authorised

to issue 5 million shares of non-voting preferred stock

amounting to nominal € 5.0 million prior to 14 May 2019.

The share premium of € 14.6 million arising on the share

capital increase was transferred to capital reserves.

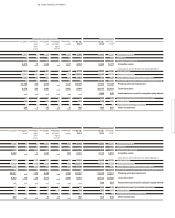

Capital reserves

Capital reserves include premiums arising from the issue

of shares and totalled € 2,005 million (2013: € 1,990 mil-

lion). The change related to the share capital increase in

conjunction with the issue of shares of preferred stock

to employees.

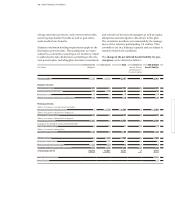

Revenue reserves

Revenue reserves comprise the post-acquisition and

non-

distributed earnings of consolidated companies. In

addition, remeasurements of the net defined benefit lia-

bility for pension plans are also presented in revenue

reserves along with positive and negative goodwill aris-

ing on the consolidation of Group companies prior to

31 December 1994.

Revenue reserves increased during the financial year

2014 to € 35,621 million. They were increased by the

amount of the net profit attributable to shareholders of

with an original term of up to three months.

end. In the case of trade receivables, collateral is gen-

erally held in the form of vehicle documents and

bank guarantees so that the risk of bad debt loss is ex-

tremely low.

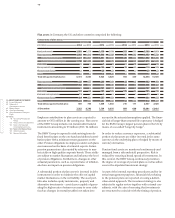

35

Equity

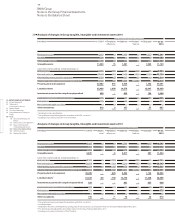

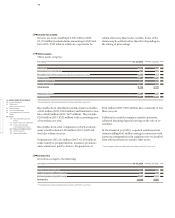

Number of shares issued

Preferred stock Common stock

2014 2013 2014 2013

Shares issued / in circulation at 1 January 54,259,787 53,994,217 601,995,196 601,995,196

Shares issued in conjunction with Employee Share Scheme 239,777 266,152 – –

Less: shares repurchased and re-issued 20 582 – –

Shares issued / in circulation at 31 December 54,499,544 54,259,787 601,995,196 601,995,196

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.