BMW 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 COMBINED MANAGEMENT REPORT

Cash outflows from operating activities of the Financial

Services segment are driven primarily by cash flows

relating to leased products and receivables from sales

financing and totalled € 4,715 million (2013: € 5,358 mil-

lion). Investing activities resulted in a cash outflow of

€ 297 million (2013: cash inflow of € 324 million).

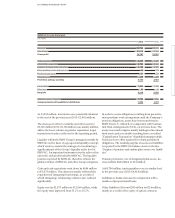

Refinancing

Operating cash flow provides a stable financial basis for

the BMW Group. A broadly based range of instruments

transacted on international money and capital markets

€ 3,204 million. A similar constellation arose in the

same period last year, when the cash outflow from

investing activities had exceeded the cash inflow from

operating activities by € 3,364.

After adjusting for the effects of exchange-rate

fluctua-

tions and changes in the composition of the BMW Group

with a total positive amount of € 88 million (2013:

negative amount of € 42 million), the various cash flows

resulted in an increase of cash and cash equivalents of

€ 17 million (2013: decrease of € 703 million).

Net financial assets of the Automotive segment com-

prise the following:

is used to refinance worldwide operations. Almost all of

the funds raised are used to finance the BMW Group’s

Financial Services business.

The cash flow statement for the Automotive segment

shows that the cash inflow from operating activities

exceeded the cash outflow from investing activities by

€ 3,587 million (2013: € 1,966 million). Adjusted for net

proceeds from marketable securities and term deposits

amounting to € 106 million (2013: net investments of

€ 1,037 million) – mainly in conjunction with securities

held for strategic liquidity purposes – the excess amount

was € 3,481 million (2013: € 3,003 million).

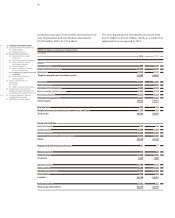

Free cash flow of the Automotive segment can be ana-

lysed

as follows:

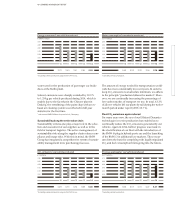

in € million 2014 2013*

Cash inflow from operating activities 9,423 9,964

Cash outflow from investing activities – 5,836 – 7,998

Net investment in marketable securities and term deposits – 106 1,037

Free cash flow Automotive segment 3,481 3,003

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.

in € million 31.12. 2014 31.12. 20131

Cash and cash equivalents 5,752 6,775

Marketable securities and investment funds 3,366 2,758

Intragroup net financial receivables 8,583 4,411

Financial assets 17,701 13,944

Less: external financial liabilities2 – 3,478 – 1,859

Net financial assets 14,223 12,085

1 Prior year figures have been adjusted in accordance with IAS 8, see note 9.

2 Excluding derivative financial instruments.