BMW 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

26 Overall Assessment by Management

26

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

61 Comments on Financial Statements

of BMW AG

64 Events after the End of the

Reporting Period

65 Report on Outlook, Risks and

Opportunities

65 Outlook

70 Report on Risks and Opportunities

82 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

The overall objective of Group financing is to ensure the

solvency of the BMW Group at all times. Achieving this

objective is tackled in three strategic areas:

1. the ability to act at all times by assuring permanent

access to strategically important capital markets,

2. autonomy through the diversification of refinancing

instruments and investors, and

3. focus on value by optimising financing costs.

Financing measures undertaken centrally ensure access

to liquidity for the Group’s operating subsidiaries on

market-based and consistent loan conditions. Funds are

acquired with a view to achieving a desired structure

for the composition of liabilities, comprising a finely

tuned mix of various financing instruments. The use

of

longer-term financing instruments to finance the

Group’s financial services business and the mainte-

nance of a sufficiently high liquidity reserve serves to

avoid the liquidity risk intrinsic to any large portfolio

of

contracts. This prudent approach to financing also

supports BMW AG’s ratings. Further information is

provided in the “Liquidity risks” section of the “Report

on outlook, risks and opportunities”.

Apart from issuing commercial paper on the money

market, the BMW Group’s financing companies also

issue bearer bonds. In addition, retail customer and

dealer financing receivables on the one hand and

leasing

rights and obligations on the other are

securi-

tised in the form of asset-backed securities (ABS) financ-

ing

arrangements. Financing instruments employed

by the Group’s in-house banks in Germany and the

USA (e. g. customer deposits) are also used as a supple-

mentary source of financing. Owing to the increased

use of international money and capital markets to raise

funds, the scale of funds raised in the form of loans

from international banks is relatively small.

Thanks to its good ratings and the high level of accept-

ance it has on capital markets, the BMW Group was

again able to refinance operations during the financial

year 2014 at attractive conditions. In addition to the

issue of bonds and loan notes on the one hand and pri-

vate placements on the other, commercial paper was

also issued on good conditions. Additional funds were

raised via new securitised instruments and the prolon-

gation of existing instruments. As in previous years,

all issues were highly sought after by private and insti-

tutional investors.

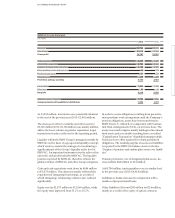

During 2014, the BMW Group issued five euro bench-

mark bonds with a total issue volume of € 4.25 billion

on European capital markets. Bonds were also issued

in Canadian dollars, British pounds, US dollars, Aus-

tralian dollars and other currencies for a total amount

of € 6.9 billion.

Nine ABS transactions were executed in 2014, including

two public transactions in the USA and one each in

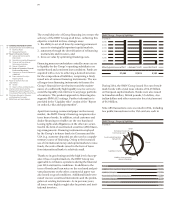

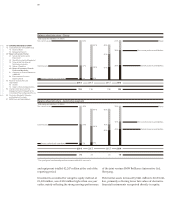

BMW Group – financial liabilities

in € million

35,000

30,000

25,000

20,000

15,000

10,000

5,000

Maturity (years) within 1

between 1 and 5

later than 5

37,482 37,974 5,193

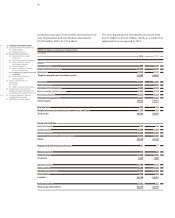

BMW Group – financial liabilities

in € million

Bonds 35,489

Liabilities from customer deposits (banking) 12,466

Liabilities to banks 11,554

Asset backed financing transactions 10,884

Commercial paper 5,599

Derivative instruments 3,143

Other 1,514

Bonds

Liabilities from customer

deposits (banking)

Derivative instruments

Other

Asset backed financing

transactions

Liabilities to banks

Commercial paper