BMW 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

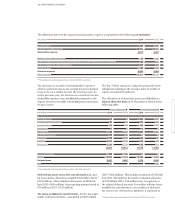

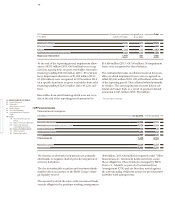

Other investments

Other investments relate to investments in non-con-

solidated subsidiaries, interests in associated com-

panies

not accounted for using the equity method

and joint operations, par ticipations and non-current

marketable securities.

The additions to investments in subsidiaries relate

primarily to a share capital increase at the level of

BMW iVentures B. V., Rijswijk.

Additions to participations mainly reflect the purchase

of available-for-sale marketable securities.

Disposals of investments in subsidiaries result from the

first-time consolidation of six European branches.

Impairment losses on participations – recognised with

income statement effect – related mainly to the

invest-

ment in SGL Carbon SE, Wiesbaden, which was written

down on the basis of objective criteria.

A break-down of the different classes of other invest-

ments disclosed in the balance sheet and changes

during the year are shown in the analysis of changes in

Group tangible, intangible and investment assets in

note 22.

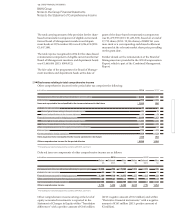

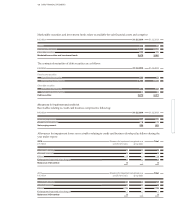

BMW Brilliance DriveNow

in € million 2014 2013 2014 2013

Disclosures relating to the balance sheet

Non-current assets 4,171 2,741 1 1

Cash and cash equivalents 976 593 13 4

Current assets 3,404 2,727 19 10

Equity 2,910 1,868 12 6

Non-current financial liabilities – – – –

Non-current provisions and liabilities 450 237 – –

Current financial liabilities 236 – – –

Current provisions and liabilities 4,215 3,363 8 5

Reconciliation of aggregated financial information

Assets 7,575 5,468 20 11

Equity and liabilities 4,665 3,600 8 5

Net assets 2,910 1,868 12 6

Group’s interest in net assets (50 %) 1,455 934 6 3

Eliminations – 373 – 299 – –

Carrying amount 1,082 635 6 3

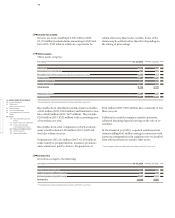

If the Group’s share of the at-equity result of BMW

Brilliance Automotive Ltd., Shenyang, were reported

as part of the Automotive segment’s EBIT, the EBIT

margin would increase by 0.9 percentage points (2013:

0.6 percentage points) to 10.5 % (2013: 10.0 %).

27