BMW 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57 COMBINED MANAGEMENT REPORT

remeasurements of the net defined benefit liability for

pension plans and currency factors (in particular relating

to the US dollar).

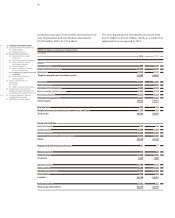

At € 6,499 million, the carrying amount of intangible as-

sets was € 320 million higher than at 31 December 2013.

Within intangible assets, capitalised development costs

rose by € 431 million. Investments in capitalised develop-

ment costs totalled € 1,499 million in the year under re-

port and were thus significantly lower than in the

pre-

vious year (2013: € 1,744 million). In the previous year,

additions to intangible assets included licenses acquired

for € 379 million which are being amortised on a straight-

line basis over a period of six years. The proportion of

development costs recognised as assets was 32.8 % (2013:

36.4 %). Adjusted for exchange rate factors, intangible

assets increased by 5.1 %. In total, € 1,561 million was in-

vested in intangible assets, most of which related to the

Automotive segment.

Total capital expenditure on intangible assets and prop-

erty, plant and equipment as a percentage of revenues

decreased to 7.6 % (2013: 8.8 %). Capital commitments

for intangible assets totalled € 750 million at the end of

the reporting period.

Noncurrent financial assets decreased by € 569 million

to € 2,024 million, mainly due to lower fair values of cur-

rency derivatives.

Within current assets, receivables from sales financing

grew from € 21,501 million to € 23,586 million, mostly

reflecting the general growth of Financial Services busi-

ness on the one hand and currency factors on the other.

Compared to the end of the previous year, inventories

increased by € 1,494 million (15.6 %) to € 11,089 million

and accounted for 7.2 % (2013: 6.9 %) of total assets. Most

of the increase related to finished goods, including the

impact of stocking up in conjunction with the

introduc-

tion of new models. Adjusted for exchange rate factors,

the increase was 11.6 %.

Current other assets were € 780 million higher than one

year earlier, mainly due to increases in prepayments,

receivables from other companies in which an invest-

ment is held and other taxes as well as the reclassifica-

tion described in note 31. These increases were partly

offset by the decrease in collateral receivables included

in this line item.

Trade receivables – which accounted for 1.4 % of total

assets (2013: 1.8 %) – went down over the twelvemonth

period by € 296 million. Adjusted for exchange rate fac-

tors, they decreased by 15.8 %.

At € 7,688 million, cash and cash equivalents were

almost identical to their level one year earlier (2013:

€ 7,671 million).

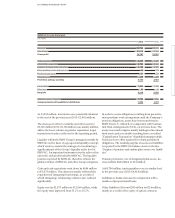

The main increase on the equity and liabilities side of

the balance sheet in percentage terms related to

pen-

sion provisions (99.9 %). Increases were also recorded

for non-current and current financial liabilities (9.4 %

and 21.5 % respectively), equity (5.2 %), current and

non-current other provisions (32.5 % and 11.5 % respec-

tively) and current and non-current other liabilities

(10.1 %

and 18.7 % respectively). By contrast, current

tax and deferred tax liabilities went down by 31.4 % and

19.7 % respectively.

Pension provisions jumped by € 2,301 million to

€ 4,604 million, mainly as a result of the lower discount

factors used in Germany, the UK and the USA.

Current and non-current financial liabilities increased

from € 70,304 to € 80,649 million over the twelve-month

period. Within financial liabilities, derivative

instru-

ments went up from € 1,103 million to € 3,143 million,

mostly reflecting the negative impact of

currency and

commodity derivatives. Additional increases within

financial liabilities included ABS transactions (7.5 %),

bonds (16.9 %) and liabilities to banks (34.5 %). By con-

trast, commercial paper decreased by 11.0 %. Adjusted

for exchange rate factors, non-current and current

financial liabilities increased by 5.0 % and 17.1 %

respec-

tively.

Group equity rose by € 1,837 million to € 37,437 million,

increased primarily by the profit attributable to

share-

holders of BMW AG (€ 5,798 million) and currency

translation differences (€ 764 million) and decreased

mainly by remeasurements of the net defined benefit

liability for pension plans (€ 2,298 million) mainly due

to the lower discount rates used in Germany, the United

Kingdom and the USA. Fair value measurement had a

negative impact in the case of derivative financial in-

struments (€ 2,194 million) and a positive impact in the

case of marketable securities (€ 40 million). Deferred

taxes on items recognised directly in equity increased

equity by € 1,438 million.