BMW 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

26 Overall Assessment by Management

26

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

61 Comments on Financial Statements

of BMW AG

64 Events after the End of the

Reporting Period

65 Report on Outlook, Risks and

Opportunities

65 Outlook

70 Report on Risks and Opportunities

82 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

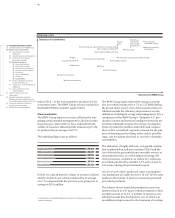

As in the previous year, Group revenues are spread

across all regions, with the Europe region (including

Germany) accounting for 46.8 % (2013: 45.2 %), the

Americas region for 20.7 % (2013: 20.7 %) and the Africa,

Asia and Oceania region for 32.5 % (2013: 34.1 %) of

business.

Revenues in the Africa, Asia and Oceania region to-

talled € 26,147 million (2013: € 25,916 million), roughly

at the previous year’s level (+ 0.9 %). In China, the

higher

proportion of sales generated by the joint ven-

ture, BMW Brilliance Ltd., Shenyang, resulted in a slight

decrease in revenues reported for this market. By con-

trast, revenues generated in South Korea were up

sig-

nificantly on the back of higher sales volume figures.

External revenue in Germany grew by 10.1 %. In the

Rest of Europe region and in the Americas region, ex-

ternal revenues increased by 9.2 % and 5.3 % respec-

tively.

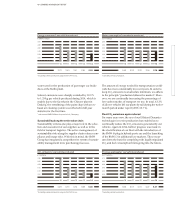

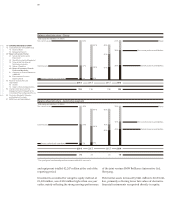

Group cost of sales were 4.3 % higher than in the pre-

vious

year and comprise mainly manufacturing costs

(2014: € 38,253 million; 2013: € 36,578 million), cost of

sales directly attributable to financial services (2014:

€ 14,716 million; 2013: € 14,044 million) and research

and development expenses (2014: € 4,135 million; 2013:

€ 4,118 million). Changes in the average exchange rates

of some currencies as well as inter-segment elimina-

tions worked in the opposite direction.

Gross profit improved by 11.4 % to € 17,005 million, re-

sulting in a gross profit margin of 21.2 % (2013: 20.1 %).

The gross profit margin recorded by the Automotive

segment was 18.6 % (2013: 18.2 %), while that of the

Motorcycles segment was 18.7 % (2013: 16.7 %). In the

Financial Services segment, the gross profit margin

improved from 13.1 % to 13.7 %.

Compared to the previous year, research and develop-

ment expenses increased by € 17 million to € 4,135 mil-

lion. As a percentage of revenues, the research and

development ratio fell by 0.3 percentage points to 5.1 %.

Research and development expenses include

amorti-

sation of capitalised development costs amounting to

€ 1,068 million (2013: € 1,069 million). Total research

and development expenditure amounted to € 4,566 mil-

lion (2013: € 4,793 million). This figure comprises

re-

search costs, non-capitalised development costs and

capitalised development costs (excluding scheduled

amortisation). The research and development expend-

iture ratio was therefore 5.7 % (2013: 6.3 %). The pro-

portion of development costs recognised as assets was

32.8 % (2013: 36.4 %).

Compared to the previous year, selling and administra-

tive expenses increased by € 635 million to € 7,892 mil-

lion. Overall, selling and administrative expenses were

equivalent to 9.8 % (2013: 9.5 %) of revenues.

Adminis-

trative expenses increased due to a number of factors,

including the higher workforce size and higher expenses

for centralised IT activities and new IT projects. Depre-

ciation and amortisation on property, plant and equip-

ment and intangible assets recorded in cost of sales and

in selling and administrative expenses amounted to

€ 4,170 million (2013: € 3,741 million).

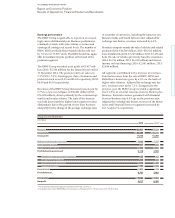

Other operating income and expenses improved from

a net expense of € 33 million to a net income of € 5 mil-

lion. The improvement was mainly attributable to gains

on the sale of assets, including those arising on the

deconsolidation of Noord Lease B.V., Groningen, and

the sale of marketable securities.

The profit before financial result (EBIT) came in at

€ 9,118 million (2013: € 7,978 million).

The financial result for the twelve-month period was a

net negative amount of € 411 million, a deterioration

of € 326 million compared to the previous year. The net

expense for other financial result increased by € 541

mil-

lion to € 747 million, mostly reflecting the negative

impact of currency and commodity derivatives.

Impair-

ment losses recognised on other investments, most

notably on the investment in SGL Carbon SE, Wiesbaden,

also contributed to the deterioration in other financial

result. By contrast, the result from equity accounted in-

vestments – which includes the Group’s share of the

results of the joint ventures BMW Brilliance Automotive

Ltd., Shenyang, DriveNow GmbH & Co. KG, Munich,

and DriveNow Verwaltungs GmbH, Munich – improved

by € 248 million.

Profit before tax increased to € 8,707 million (2013:

€ 7,893 million). The pre-tax return on sales was 10.8 %

(2013: 10.4 %).

Income tax expense amounted to € 2,890 million (2013:

€ 2,564 million), resulting in an effective tax rate of

33.2 % (2013: 32.5 %). The changed regional earnings