BMW 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67 COMBINED MANAGEMENT REPORT

Stable conditions are also predicted for used car

mar-

kets in Asia and Europe in 2015, while price levels in

North America are, at the most, only likely to fall

slightly.

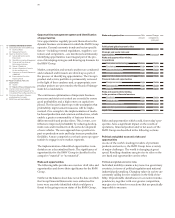

Expected impact on the BMW Group in 2015

Future developments on international automobile

mar-

kets also have a direct impact on the BMW Group.

While competition is likely to intensify in contracting

markets, new opportunities are opening in growth

regions. In some countries, sales volumes will be influ-

enced to a great extent by the way we tackle new com-

petitive challenges. After the uncertainties that have

dominated recent years, we expect Europe to generate

some positive momentum again, albeit on a slight scale.

North America and China are likely to see a continua-

tion of the positive trend in 2015. In contrast, the situa-

tion on the Russian car market can be expected to re-

main tense over the forecast period.

As an enterprise with global operations, the BMW

Group is ideally placed to exploit opportunities that

arise and thus compensate for unfavourable

develop-

ments in other regions. Thanks to its strong brands, we

forecast continued profitable growth for the BMW

Group in the current year. We will push ahead with in-

vestments in innovation, future technologies and the

further internationalisation of our production network

in 2015. As a manufacturer of premium vehicles, we will

continue to profit from strong worldwide demand in

this segment. Given all these factors, we forecast that

the BMW Group will remain the world’s leading pre-

mium manufacturer in 2015.

Our highly flexible

international production network

enables us to compensate for even substantial fluctua-

tions

in demand. Investing in major growth markets

provides the basis for the continued success of the BMW

Group. We attach great importance to ensuring that

the global distribution of our sales remains balanced,

while simultaneously expanding the global presence of

the BMW Group.

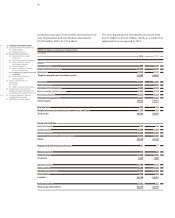

Outlook for the BMW Group in 2015

The BMW Group in 2015

Profit before tax: solid increase expected

The BMW Group will remain on course in 2015 and

forecasts a solid increase in Group profit before tax

compared to the preceding year (2014: € 8,707 million).

However, the scale of the increase during the forecast

period is likely to be held down by intense competition

on car markets, rising personnel costs, continued high

levels of upfront expenditure to safeguard business

viability going forward and future challenges arising in

the wake of the normalisation of the Chinese market.

A number of risks will also have to be faced, including

the precarious state of the Russian market and macro-

economic uncertainties in Europe (see the section “Po-

litical and global economic risks” in the risk report).

We

expect our attractive model range to generate positive

momentum, which will help us achieve our target of

balanced growth on all major markets.

Workforce at year-end: solid increase expected

The BMW Group will continue to recruit staff in 2015

and, based on our latest forecasts, we expect a solid in-

crease in the size of the workforce (2014: 116,324 em-

ployees), driven by car and motorcycle sales growth and

the rapid pace of innovation.

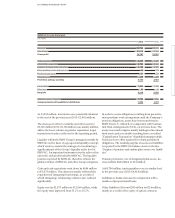

Automotive segment in 2015

Deliveries to customers: solid increase expected

We expect the pace of growth in the Automotive seg-

ment

to remain high in 2015. Assuming economic

conditions continue to be stable, we predict a solid rise

in deliveries to customers (2014: 2,117,965 units) to

achieve a new high level, which will, in all probability,

enable the BMW Group to maintain its position as the

world’s foremost premium car manufacturer in 2015.

Attractive new models and dynamic market conditions,

particularly in North America, should have a positive

impact on car sales. After some negative

developments

in recent years, the European car markets

are expected

to recover slightly overall. Nevertheless, the market en-

vironment is likely to remain challenging.

The new 2 Series Convertible was added to the BMW 2 Se-

ries

with effect from the end of February. Its

predeces-

sor, the 1 Series Convertible, achieved worldwide sales

of more than 130,000 units and was therefore the un-

disputed leader in its class.

In April, the four-wheel drive BMW X5 M and X6 M will

come onto the market. These high-performance models

combine the characteristic features of the successful

BMW X family – exclusivity, robustness, agility and every

day usability – with the commitment to high perfor-

mance that defines an M car.

The new facelift of the BMW 1 Series, unveiled at the

Geneva Motor Show, will provide additional sales

momentum. With a fully revamped engine range and

additional features that reduce fuel consumption and