BMW 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

26 Overall Assessment by Management

26

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

61 Comments on Financial Statements

of BMW AG

64 Events after the End of the

Reporting Period

65 Report on Outlook, Risks and

Opportunities

65 Outlook

70 Report on Risks and Opportunities

82 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

but also the Chinese renminbi, the British pound and

the Japanese yen, could well be subject to a significant

degree of fluctuation again in 2015.

The expected interest rate turnaround in the USA, low

inflation in Europe and the fragile state of Europe’s

economy, suggest that the US dollar will again tend to

perform strongly against the euro in 2015.

The Chinese renminbi is likely to remain relatively closely

coupled with the US dollar over the coming year. In the

long term, however, it seems likely that volatility will

increase, following the announcement that capital mar-

kets in China are to be liberalised.

The Japanese yen, which has lost significant ground

against the euro since mid-2012, is not expected to see a

rapid recovery, given that the Japanese central bank is

unlikely to change its monetary and exchange rate poli-

cies in the near future.

The current healthy state of the UK economy and the

expected turnaround in interest rates that the Bank of

England is likely to set in motion could well strengthen

the British pound somewhat in the short and medium

term.

The currencies of many emerging economies are expected

to remain under pressure against the US dollar in the

foreseeable future, due to the normalisation of US mon-

etary policies, which is likely to get under way in 2015.

Countries with current account and fiscal deficits are

most likely to be affected. Due to the expansionary mon-

etary policies of the ECB, emerging market currencies

will tend to gain in value against the euro. The rouble

will remain on the weak side until political tensions have

eased.

Car markets

We expect global car markets to grow in the current year

by approximately 3.0 % to 83.1 million units. The US

market is forecast to grow by around 2.9 % to 17.0 mil-

lion units. Our prediction for passenger car registra-

tions in China is a rise of around 10.0 % to 20.3 million

units.

The majority of Europe’s car markets should continue

to recover in 2015. The region’s core markets, however,

are only likely to see growth on a modest scale. The

number of new registrations in Germany, for instance,

is forecast to rise by 2.1 % to 3.1 million. The French

market is expected to grow by 6.7 % to 1.9 million units,

the Italian market by 2.1 % to 1.4 million units. The

economic upturn in Spain should maintain momentum

and result in a further steep rise in car sales in the

cur-

rent year (0.95 million units; + 11.3 %). The UK car market

is likely to remain flat in 2015, with registrations down

marginally by 0.5 % to approximately 2.5 million units.

Car registrations in Japan are forecast to be in the region

of 4.8 million units and hence about 10.0 % lower than

in the previous year.

In

the case of car markets in major emerging econo-

mies, we predict some highly divergent developments.

Due to the prevailing economic and political situation,

Russia is expected to see a further 21.8 % drop to 1.8 mil-

lion units. The Brazilian car market is also likely to con-

tract slightly again in 2015 by approximately 2.0 % to

3.3 million units.

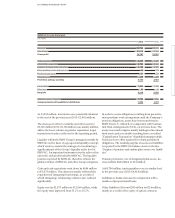

Motorcycle markets in 2015

The markets for 500 cc plus motorcycles are again likely

to continue their upward trend in 2015, albeit on a

modest scale. Registrations are expected to rise slightly

across Europe, including increases on a similar scale

for the major motorcycle markets in Germany, Italy and

France. The USA is also likely to see a continuation of

the positive trend.

Financial Services sector in 2015

The normalisation of monetary policies in the USA is

expected to continue throughout the coming year. The

first steps in the direction of a slight rise in interest

rates

might be taken in summer 2015. The current debt

situation, however, precludes any rapid interest rate

increases in the USA. In Europe, by contrast, the ECB

will proceed with the plans it has already announced

for a large scale bond-buying programme as inflation

remains low in the first half of 2015. A weakly perform-

ing economy and a low inflation rate will maintain the

pressure on the Bank of Japan to intervene. We there-

fore

expect it to retain its expansionary monetary poli-

cies and continue to buy government bonds. Reference

interest rates in

the eurozone and Japan are therefore

set to remain at historically low levels at least until the

end of 2015.

We expect the pattern of credit risks worldwide to re-

main more or less stable during the current year.