BMW 2014 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

45

Related party relationships

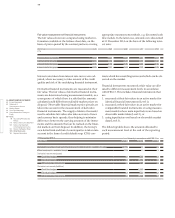

In accordance with IAS 24 (Related Party Disclosures),

related individuals or entities which have the ability to

control the BMW Group or which are controlled by the

BMW Group, must be disclosed unless such parties are

already included in the Group Financial Statements of

BMW AG as consolidated companies. Under the

con-

trol concept established in IFRS 10, an investor controls

another entity when it is exposed to or has rights to

variable returns from its involvement with the investee

and has the ability to affect those returns through its

power over the investee.

In addition, the disclosure requirements of IAS 24 also

cover transactions with associated companies, joint

ventures, joint operations and individuals that have the

ability to exercise significant influence over the finan-

cial and operating policies of the BMW Group. This also

includes close relatives and intermediary entities. Sig-

nificant influence over the financial and operating poli-

cies of the BMW Group is presumed when a party holds

20 % or more of the voting power of BMW AG. In addi-

tion, the requirements contained in IAS 24 relating to

key management personnel and close members of their

families or intermediary entities are also applied. In the

case of the BMW Group, this applies to members of the

Board of Management and Supervisory Board.

In the financial year 2014, the disclosure requirements

contained in IAS 24 affect the BMW Group with re-

gard

to business relationships with non-consolidated

subsidiaries, joint ventures, joint operations and

asso-

ciated companies as well as with members of the

Board

of Management and Supervisory Board of BMW AG.

The BMW Group maintains normal business relation-

ships with non-consolidated subsidiaries. Transactions

with these companies are small in scale, arise in the

normal course of business and are conducted on the

basis of arm’s length principles.

Transactions of BMW Group companies with the joint

venture BMW Brilliance Automotive Ltd., Shenyang,

all arise in the normal course of business and are

con-

ducted on the basis of arm’s length principles. Group

companies sold goods and services to BMW Brilliance

Automotive Ltd., Shenyang, during the financial year

under report for an amount of € 4,417 million (2013:

€ 3,588 million). At 31 December 2014, receivables of

Group companies from BMW Brilliance Automotive

Ltd., Shenyang, totalled € 943 million (2013: € 898

mil-

lion). Group companies had no payables to BMW

Brilliance Automotive Ltd., Shenyang, at the end of

the

reporting period (2013: € 66 million). Group compa-

nies

received goods and services from BMW Brilliance

Auto

motive Ltd., Shenyang, in 2014 for an amount of

€ 34 million (2013: € 31 million).

All relationships of BMW Group entities with the joint

ventures DriveNow GmbH & Co. KG, Munich, and

DriveNow Verwaltungs GmbH, Munich, are conducted

on the basis of arm’s length principles. Transactions

with these entities arise in the normal course of business

and are small in scale.

Transactions of Group companies with SGL Automotive

Carbon Fibers GmbH & Co. KG, Munich, SGL Auto-

motive Carbon Fibers Verwaltungs GmbH, Munich, and

SGL Automotive Carbon Fibers LLC, Dover, DE, were

reported in their entirety in the Group Financial State-

ments until 1 January 2014. As a result of the first-time

application of IFRS 11 (Joint Arrangements) in the finan-

cial

year 2014, these entities are now consolidated, as

joint operations, on a proportionate basis (49 %) and

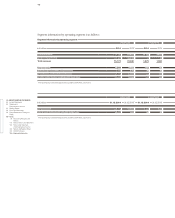

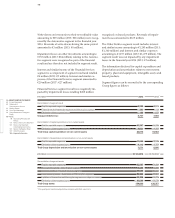

The changes in balance sheet positions shown in the

cash flow statement do not therefore agree directly with

the amounts shown in the Group and segment balance

sheets.

Cash inflows and outflows relating to operating leases,

where the BMW Group is the lessor, are aggregated and

shown on the line “Change in leased products” within

cash flows from operating activities.

The net change in receivables from sales financing (in-

cluding finance leases, where the BMW Group is the

lessor) is also reported within cash flows from operating

activities.

Income taxes paid and interest received are classified

as cash flows from operating activities in accordance

with IAS 7.31 and IAS 7.35. Interest paid is presented

on a separate line within cash flows from financing ac-

tivities. Dividends received in the financial year 2014

amounted to € 1 million (2013: € 4 million).