BMW 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

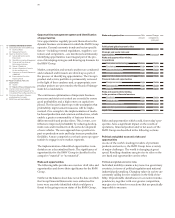

79 COMBINED MANAGEMENT REPORT

of cash flow requirements and sourcing forecast sys-

tem

in place throughout the Group. Liquidity risks may

be reflected in rising refinancing costs. They may also

manifest themselves in restricted access to funds as a

consequence of the general market situation or the de-

fault of individual banks. The major part of the Finan-

cial Services segment’s credit financing and lease

busi-

ness is refinanced on capital markets. Thanks to its

excellent creditworthiness, the BMW Group has good

access to financial markets and, as in previous years,

was able to raise funds at good conditions in 2014, re-

flecting a diversified refinancing strategy and the solid

liquidity and earnings base of the BMW Group. Inter-

nationally recognised rating agencies have additionally

confirmed the BMW Group’s solid creditworthiness.

If liquidity risks were to materialise, they are only likely

to result in a low impact on the BMW Group’s results

of operations over the two-year assessment period.

The risk of incurring liquidity risk is classified as low –

including the risk of the BMW Group’s rating being

downgraded and any ensuing deterioration in financing

conditions.

If the relevant recognition criteria are fulfilled,

deriva-

tives used by the BMW Group are accounted for as

hedging relationships. Further information on risks in

conjunction with financial instruments is provided in

note 43 to the Group Financial Statements.

Risks and opportunities relating to Financial Services

The categories of risk relating to the provision of finan-

cial services are credit and counterparty risk, residual

value risk, interest rate risk, liquidity risk and opera-

tional risk. In order to evaluate and manage these risks,

a variety of internal methods has been developed

based

on regulatory environment requirements (such

as Basel III) and which comply with both national and

international standards. A set of strategic principles

and rules derived from regulatory requirements serves

as the basis for risk management within the Financial

Services segment. At the heart of the risk management

process is a clear division between front- and back-of-

fice activities and a comprehensive internal control sys-

tem. The key risk management tool employed

within

the Financial Services segment is aimed at ensuring

that the Group’s risk-bearing capacity is not exceeded.

In this context, all risks (defined as “unexpected losses”)

must be covered at all times by an appropriate asset

cushion in the form of equity capital. Unexpected losses

are measured using a variety of value-at-risk techniques,

adapted to each relevant risk category. Risks are aggre-

gated after taking account of correlation effects. The

total amount of risks calculated in this way is then com-

pared with the resources available to cover risks (asset

cushion). The segment’s risk-bearing capacity is moni-

tored

continuously with the aid of an integrated limit

system which also differentiates between the various risk

categories. The segment’s total risk exposure was

covered at all times during the past year by the available

risk-coverage volumes.

Credit and counterparty risks and opportunities

Credit and counterparty default risk arises within the

Financial Services segment if a contractual partner (i. e.

a customer or dealer) either becomes unable or is only

partially able to fulfil its contractual obligations, such

that lower income is generated or losses incurred. The

Financial Services segment uses a variety of rating

systems in order to assess the creditworthiness of its

contractual partners. Credit risks are managed at the

time of the initial credit decision on the basis of a calcu-

lation of the present value of standard risk costs and

subsequently, during the term of the credit, by using a

range of risk provisioning techniques to cover risks

emanating from changes in customer creditworthiness.

In this context, individual customers are classified by

category each month on the basis of their current con-

tractual status, and appropriate levels of allowance

recognised in accordance with that classification. If

economies develop more favourably than assumed in

the outlook, there is a chance that credit losses may be

reduced and earnings improved accordingly.

If credit and counterparty risks were to materialise, they

could have a medium impact on the BMW

Group’s

results of operations over the two-year assessment pe-

riod.

The level of risk attached to credit and counter-

party risks is classified as high. The BMW Group classi-

fies potential opportunities in this area as material.

Residual value risks and opportunities

Risks and opportunities arise at the end of the contrac-

tual term of a lease if the market value of the leased vehi-

cle differs from the residual value calculated at the

in-

ception of the lease and factored into the lease payments.