BMW 2014 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

168

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

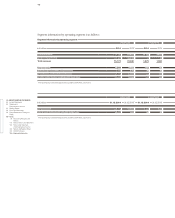

in € million 2014 2013*

Reconciliation of segment result

Total for reportable segments 9,233 8,511

Financial result of Automotive segment and Motorcycles segment – 363 – 91

Elimination of inter-segment items – 163 – 527

Group profit before tax 8,707 7,893

Reconciliation of capital expenditure on non-current assets

Total for reportable segments 25,297 24,228

Elimination of inter-segment items – 4,621 – 4,325

Total Group capital expenditure on non-current assets 20,676 19,903

Reconciliation of depreciation and amortisation on non-current assets

Total for reportable segments 11,683 10,743

Elimination of inter-segment items – 4,112 – 3,787

Total Group depreciation and amortisation on non-current assets 7,571 6,956

in € million 31. 12. 2014 31. 12. 2013*

Reconciliation of segment assets

Total for reportable segments 82,937 74,494

Non-operating assets – Other Entities segment 6,658 5,989

Operating liabilities – Financial Services segment 96,959 83,942

Interest-bearing assets – Automotive and Motorcycles segments 39,449 37,357

Liabilities of Automotive and Motorcycles segments not subject to interest 28,488 25,473

Elimination of inter-segment items – 99,688 – 88,878

Total Group assets 154,803 138,377

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.

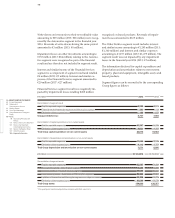

Write-downs on inventories to their net realisable value

amounting to € 29 million (2013: € 28 million) were recog-

nised by the Automotive segment in the financial year

2014. Reversals of write-downs during the same period

amounted to € 3 million (2013: € 4 million).

Impairment losses on other investments amounting to

€ 153 million (2013: € 84 million) relating to the Automo-

tive segment were recognised as part of the financial

result and are therefore not included in segment result.

Interest and similar income of the Financial Services

segment is a component of segment result and totalled

€ 4 million (2013: € 5 million). Interest and similar ex-

penses of the Financial Services segment amounted to

€ 29 million (2013*: € 27 million).

Financial Services segment result was negatively im-

pacted by impairment losses totalling € 268 million

recognised on leased products. Reversals of impair-

ment losses amounted to € 169 million.

The Other Entities segment result includes interest

and similar income amounting to € 1,295 million (2013:

€ 1,340 million) and interest and similar expenses

amounting to € 1,197 million (2013: € 1,279 million). The

segment result was not impacted by any impairment

losses in the financial year 2014 (2013: € 7 million).

The information disclosed for capital expenditure and

depreciation and amortisation relates to non-current

property, plant and equipment, intangible assets and

leased products.

Segment figures can be reconciled to the corresponding

Group figures as follows: