BMW 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

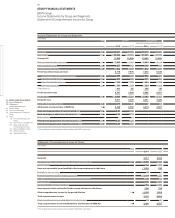

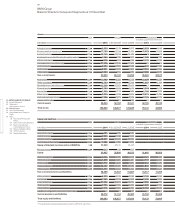

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

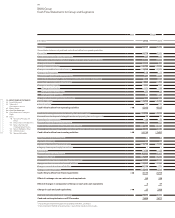

Consolidation principles

The equity of subsidiaries is consolidated in accordance

with IFRS 3 (Business Combinations). IFRS 3 requires

that all business combinations are accounted for using

the acquisition method, whereby identifiable assets and

liabilities acquired are measured at their fair value at

acquisition date. An excess of acquisition cost over the

Group’s share of the net fair value of identifiable assets,

liabilities and contingent liabilities is recognised as good-

will as a separate balance sheet line item and allocated

to the relevant cash-generating unit (CGU). Goodwill of

€ 91 million which arose prior to 1 January 1995 remains

netted against reserves.

Receivables, payables, provisions, income and expenses

and profits between consolidated companies (intra-group

profits) are eliminated on consolidation.

Joint operations and joint ventures are forms of joint

arrangements. Such an arrangement exists when the

BMW Group jointly carries out activities on the basis of

a contractual agreement with a third party that requires

the unanimous consent of both parties with respect to

all significant activities of the joint arrangement.

In the case of a joint operation, the parties that have joint

control of the arrangement have rights to the assets,

and obligations for the liabilities, relating to the arrange-

ment. Assets, liabilities, revenues and expenses of a

joint operation are recognised proportionately in the

Group Financial Statements on the basis of the BMW

Group’s rights and obligations.

Investments accounted for using the equity method

(joint ventures and associated companies) are measured

at the BMW Group’s share of equity taking account of

fair value adjustments. Any difference between the cost

of investment and the Group’s share of equity is ac-

counted for in accordance with the acquisition method.

Investments in other companies are accounted for as

a general rule using the equity method when significant

influence can be exercised (IAS 28 Investments in Asso-

ciates and Joint Ventures). As a general rule, there is a

rebuttable assumption that the Group has significant in-

fluence

if it holds between 20 % and 50 % of the associated

company’s or joint venture’s voting power.

4

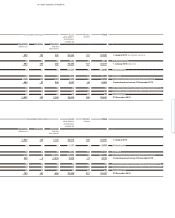

Sale of business

With the purchase of the ING Car Lease Group in

2011, the BMW Group also acquired Noord Lease B. V.,

Groningen. This entity was managed alongside Alphabet

Nederland B. V., Breda, as a second fleet leasing com-

pany in the Netherlands, with a strong regional focus

and a high proportion of private leasing. As part of an

evaluation of the strategic direction of fleet business

in the Netherlands, it was decided to focus on only one

company in this region. Accordingly, BMW AG’s Board

B. V., Groningen, was sold and therefore ceased to be a

consolidated company. In addition, Alphabet Belgium

N. V., Bornem, and Bavaria NTTBL Company Ltd.,

Dublin, were liquidated and ceased to be consolidated

companies. The British Motor Corporation Ltd.,

Bracknell, was wound up and ceased to be a consolidated

company.

of Management put up Noord Lease B. V., Groningen

for sale during the financial year 2014. At the end of

a bidding process, Noord Lease B. V., Groningen, was

sold to Noordlease

Midco B. V., Groningen. The pur-

chase agreement was signed in June 2014 and the

shares transferred in August 2014. The deconsolidation

of Noord Lease B. V., Groningen, gave rise in the third

quarter to a gain of € 7.4 million, which is included in

other operating income and expenses of the Financial

Services segment.

The Group reporting entity also changed by comparison

to the previous year as a result of the first-time consoli-

dation of six special purpose trusts and the deconsolida-

tion of eight special purpose entities.

The changes to the composition of the Group do not have

a material impact on the results of operations, financial

position or net assets of the Group.

3