BMW 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

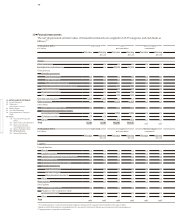

143 GROUP FINANCIAL STATEMENTS

at the end of the reporting period, if the other assump-

tions used in the calculation were kept constant. The

defined benefit obligation amounted to € 20,462 million

at 31 December 2014.

The weighted duration of all pension obligations in

Germany, the UK and other countries (based on present

values of the defined benefit obligation) developed as

follows:

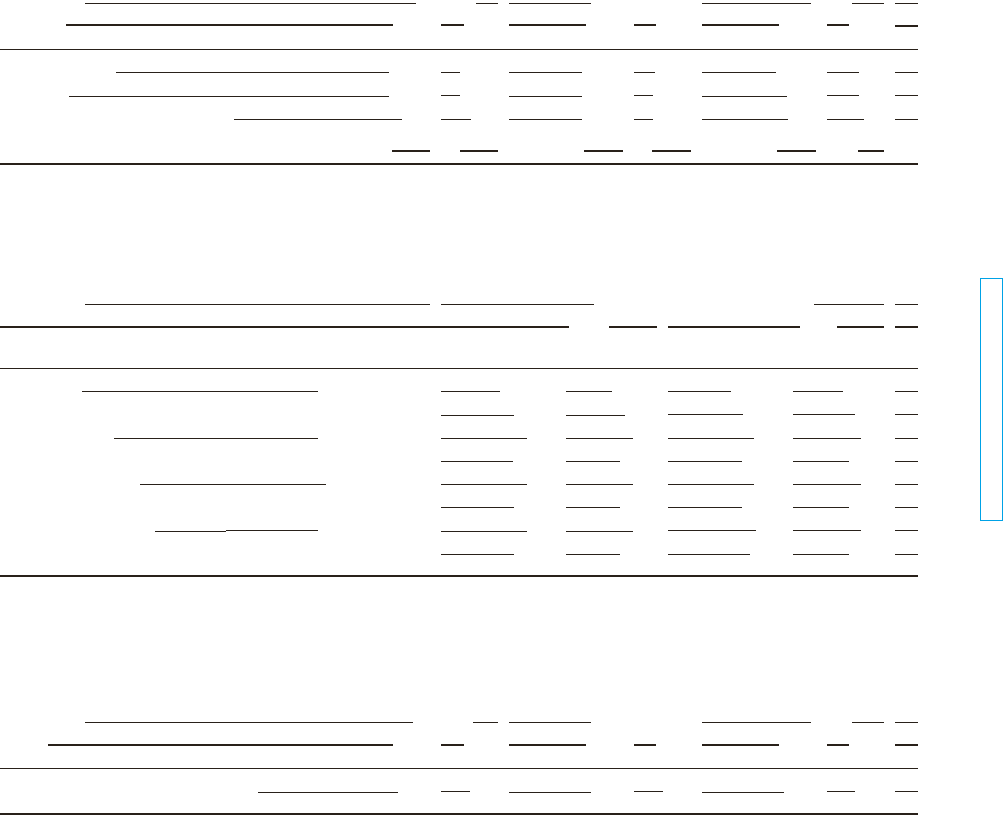

The sensitivity analysis provided below shows the ex-

tent

to which – based on an appropriate review – the

defined benefit obligation would have been affected by

changes in the relevant assumptions that were possible

In the UK, the sensitivity analysis for the pension level

trend also takes account of restrictions due to caps and

floors.

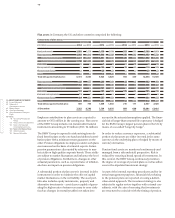

payments and the expected pattern of pension obliga-

tions. In their own way, each of these measures helps to

reduce fluctuations in pension funding shortfalls.

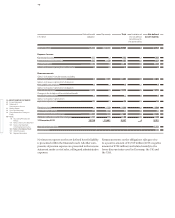

Most of the BMW Group’s pension assets are adminis-

tered separately and kept legally segregated from com-

pany assets using trust fund arrangements. As a conse-

quence, the level of funds required to finance pension

payments out of operations will be substantially

re-

duced in the future, since most of the Group’s pension

obligations are settled out of the assets of pension

funds / trust fund arrangements.

The defined benefit obligation relates to current

em-

ployees, former employees with vested benefits and

pensioners as follows:

31 December Germany United Kingdom Other

in € million 2014 2013 2014 2013 2014 2013

Current employees 6,495 4,715 2,295 1,604 1,003 723

Pensioners 2,650 2,297 4,208 3,651 212 141

Former employees with vested benefits 491 388 2,996 2,154 112 85

Defined benefit obligation 9,636 7,400 9,499 7,409 1,327 949

31 December Germany United Kingdom Other

in years 2014 2013 2014 2013 2014 2013

Weighted duration of all pension obligations 21.4 19.6 19.9 18.3 19.2 14.9

31 December Change in defined benefit obligation

2014 2013

in € million in % in € million in %

Discount rate increase of 0.75 % – 2,888 – 14.1 – 2,028 – 12.9

decrease of 0.75 % 3,675 18.0 2,528 16.0

Pension level trend increase of 0.25 % 727 3.6 506 3.2

decrease of 0.25 % – 679 – 3.3 – 479 – 3.0

Average life expectancy increase of 1 year 703 3.4 510 3.2

decrease of 1 year – 700 – 3.4 – 514 – 3.3

Pension entitlement trend increase of 0.25 % 152 0.7 101 0.6

decrease of 0.25 % – 146 – 0.7 – 97 – 0.6