BMW 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69 COMBINED MANAGEMENT REPORT

Return on capital employed in line with last year’s level

expected

We expect the impetus provided by the new models

will help keep segment RoCE in line with last year’s

level (2014: 21.8 %).

Financial Services segment in 2015

Return on equity in line with last year’s level expected

Based on our assessment, the Financial Services segment

will continue to perform well in 2015. Despite rising

equity capital requirements worldwide, we forecast RoE

in line with last

year’s level

(2014: 19.4 %),

thus remain-

ing ahead of the target of at least 18 %.

Overall assessment by Group management for 2015

We forecast a continuation of the upward trend in 2015

and expect to achieve profitable growth on the back

of a

range of factors, including the introduction of

new

models. Despite the aforementioned challenges, Group

profit before tax is forecast to achieve a solid increase,

thus reflecting the solid growth in sales volume and

revenues anticipated by the Automotive segment. At

the same time, we expect a slight decrease in carbon

emissions from our fleet of vehicles. We aim to achieve

profitable

growth through a solid increase in the size

of the

workforce across the Group. The Automotive seg-

ment’s

EBIT margin will remain within the target range

of

between 8 and 10 %. Based on the planned level of

capital expenditure, we expect a moderate decrease in

the Automobile segment’s RoCE. The Financial Services

segment’s RoE should remain in line with last year’s

level. Both performance indicators will be nevertheless

higher than their long-term targets of 26 % and 18 %

respectively. For the Motorcycles segment, we forecast

a solid increase in sales volume and RoCE in line

with

last year’s level. Depending on the political and

economic situation and the outcome of the risks and

opportunities described below, actual business per-

formance could, however, differ from our current ex-

pectations.

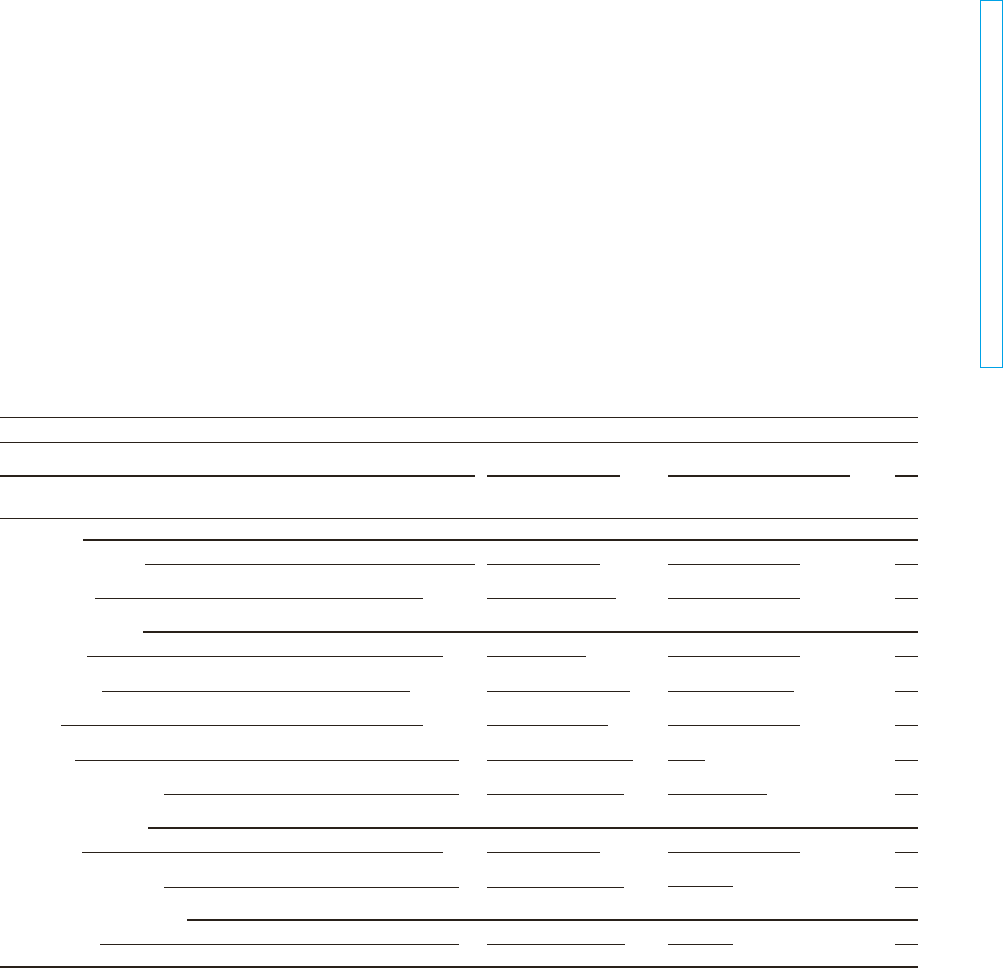

Principal performance indicators

2014 2015

Outlook

BMW Group

Workforce at end of year 116,324 solid increase

Profit before tax € million 8,707 solid increase

Automotive segment

Sales volume1 units 2,117,965 solid increase

Fleet emissions2 g CO2

/ km 130

slight decrease

Revenues € million 75,173 solid increase

EBIT margin % 9.6 unchanged between 8 and 10

Return on capital employed % 61.7 moderate decrease

Motorcycles segment

Sales volume units 123,495 solid increase

Return on capital employed % 21.8

in line with last year’s level

Financial Services segment

Return on equity % 19.4

in line with last year’s level

1 Including the joint venture BMW Brilliance Automotive Ltd., Shenyang (2014:

275,891

units).

2 EU-28.