BMW 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

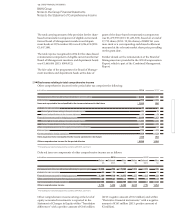

119 GROUP FINANCIAL STATEMENTS

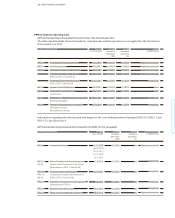

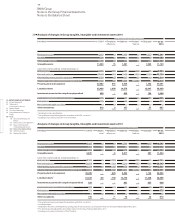

The difference between the expected and actual tax expense is explained in the following reconciliation:

Tax increases as a result of non-deductible expenses

and tax reductions due to tax-exempt income remained

more or less at

a similar level to the previous year. As

in the previous

year, tax increases as a result of non-tax-

deductible expenses were attributable primarily to the

impact of non-recoverable withholding taxes and trans-

fer price issues.

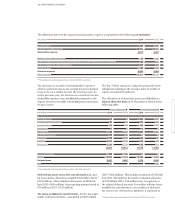

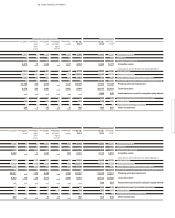

Deferred tax assets on tax loss carryforwards and capi-

tal losses before allowances totalled € 566 million (

2013*

:

€ 512 million). After valuation allowances of € 496 mil-

lion (

2013

: € 409 million), their carrying amount stood at

€ 70 million (

2013*

: € 103 million).

Tax losses available for carryforward – for the most part

usable without restriction – amounted to € 469 million

The line “Other variances” comprises primarily recon-

ciling items relating to the Group’s share of results of

equity accounted investments.

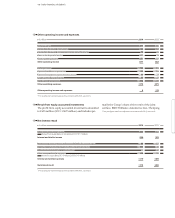

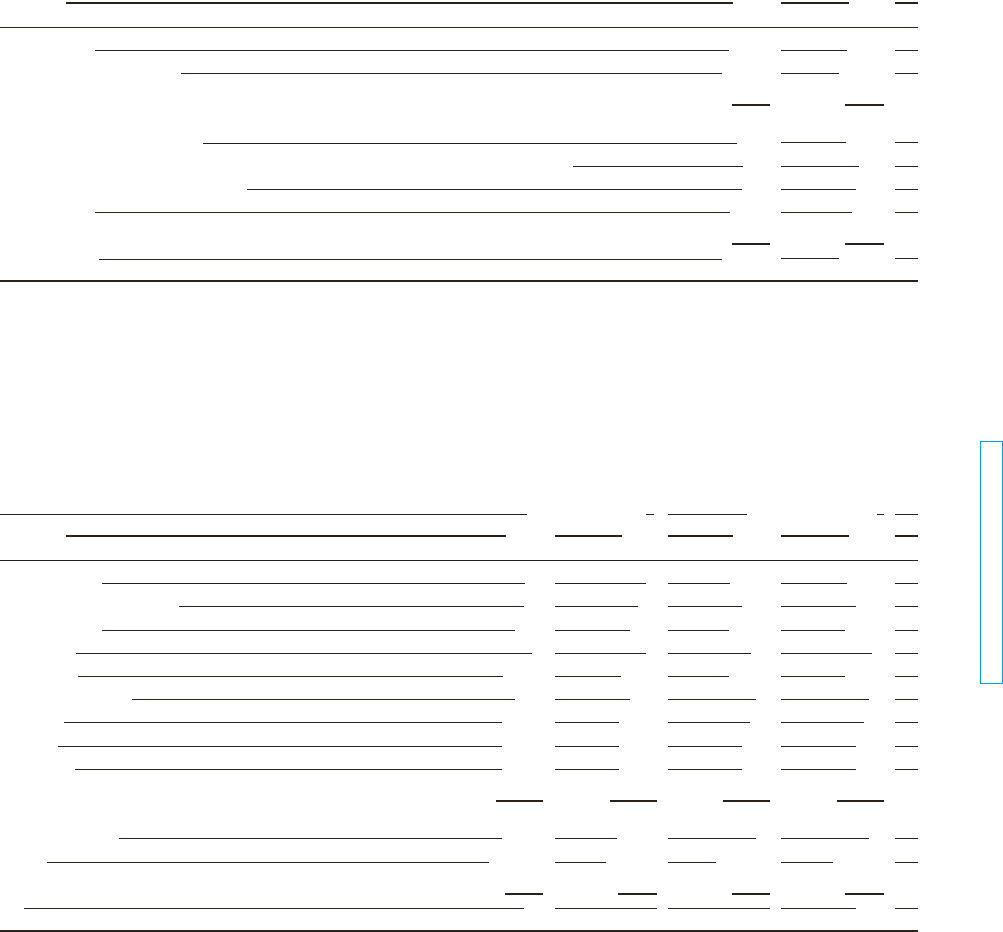

The allocation of deferred tax assets and liabilities to

balance sheet line items at 31 December is shown in the

following table:

(2013*: € 402 million). This includes an amount of € 228 mil-

lion (2013: € 42 million), for which a valuation allowance

of € 74 million (2013: € 14 million) was recognised on

the related deferred tax asset. For entities with tax losses

available for carryforward, a net surplus of deferred

tax assets over deferred tax liabilities is reported at

Deferred tax assets Deferred tax liabilities

in € million 2014 2013* 2014 2013*

Intangible assets 11 9 1,706 1,571

Property, plant and equipment 50 26 400 264

Leased products 393 436 5,486 4,498

Investments 5 6 12 5

Other assets 1,289 1,078 2,687 3,747

Tax loss carryforwards 566 512 – –

Provisions 4,175 3,220 95 47

Liabilities 2,827 2,955 602 449

Eliminations 2,945 2,570 690 661

12,261 10,812 11,678 11,242

Valuation allowance – 496 – 409 – –

Netting – 9,704 – 8,783 – 9,704 – 8,783

Deferred taxes 2,061 1,620 1,974 2,459

Net 87 839

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.

in € million 2014 2013*

Profit before tax 8,707 7,893

Tax rate applicable in Germany 30.7 % 30.5 %

Expected tax expense 2,673 2,407

Variances due to different tax rates – 55 – 134

Tax increases (+) / tax reductions (–) as a result of non-deductible expenses and tax-exempt income 150 164

Tax expense (+) / benefits (–) for prior years 275 222

Other variances – 153 – 95

Actual tax expense 2,890 2,564

Effective tax rate 33.2 % 32.5 %

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.