BMW 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

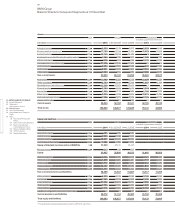

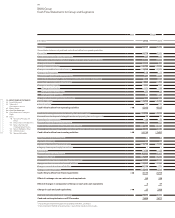

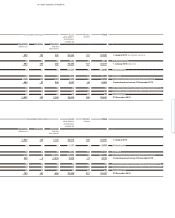

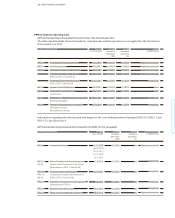

102

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

of other intangible assets relating to production), write-

downs on inventories, freight and insurance costs re-

lating

to deliveries to dealers and agency fees on direct

sales. Expenses which are directly attributable to finan-

cial services business (including depreciation on leased

products), the interest expense from refinancing the

entire financial services business as well as the expense

of risk provisions and write-downs relating to such busi-

ness are also reported in cost of sales.

In accordance with IAS 20 (Accounting for Government

Grants and Disclosure of Government Assistance), pub-

lic sector grants are not recognised until there is reason-

able assurance that the conditions attaching to them

have been complied with and the grants will be received.

They are recognised as income over the periods neces-

sary to match them with the related costs which they are

intended to compensate.

Basic earnings per share are computed in accordance with

IAS 33 (Earnings per Share). Basic earnings per share

are calculated for common and preferred stock by di-

viding

the Group net profit after minority interests, as

attributable to each category of stock, by the average

number of outstanding shares. The net profit is accord-

ingly allocated to the different categories of stock. The

portion of the Group net profit for the year which is not

being distributed is allocated to each category of stock

based on the number of outstanding shares. Profits

available for distribution are determined directly on the

basis of the dividend resolutions passed for common

and preferred stock. Diluted earnings per share are dis-

closed separately.

Share-based remuneration programmes which are ex-

pected

to be settled in shares are, in accordance with

IFRS 2 (Share-based Payments), measured at their fair

value at grant date. The related expense is recognised

in the income statement (as personnel expense) over

the vesting period, with a contra (credit) entry recorded

against capital reserves.

Share-based remuneration programmes expected to be

settled in cash are revalued to their fair value at each

balance sheet date between the grant date and the settle-

ment

date and on the settlement date itself. The

ex-

pense for such programmes is recognised in the income

statement (as personnel expense) over the vesting period

of the programmes and recognised in the balance sheet

as a provision.

The share-based remuneration programme for Board

of

Management members and senior heads of depart-

ment

entitles BMW AG to elect whether to settle its

commitments in cash or with shares of BMW AG

com-

mon stock. Following the decision to settle in cash,

this programme is accounted for as a cash-settled

share-based transaction. Further information on

share-based remuneration programmes is provided

in note 20.

Purchased and internally-generated intangible assets are

recognised as assets in accordance with IAS 38

(Intan-

gible Assets), where it is probable that the use of the asset

will generate future economic benefits and where the

costs of the asset can be determined reliably. Such assets

are measured at acquisition and / or manufacturing cost

and, to the extent that they have a finite useful life,

amortised over their estimated useful lives. With the ex-

ception

of capitalised development costs, intangible

assets are generally amortised over their estimated use-

ful lives of between three and ten years.

Development costs for vehicle and engine projects are

capitalised at manufacturing cost, to the extent that

attributable costs can be measured reliably and both

technical feasibility and successful marketing are as-

sured. It must also be probable that the development

expenditure will generate future economic benefits.

Capitalised development costs comprise all expenditure

that can be attributed directly to the development pro-

cess, including development-related overheads. Capi-

talised

development costs are amortised systematically

over the estimated product life (usually four to eleven

years) following start of production.

Goodwill arises on first-time consolidation of an acquired

business when the cost of acquisition exceeds the

Group’s share of the fair value of the individually iden-

tifiable assets acquired and liabilities and contingent

liabilities assumed.

All items of property, plant and equipment are considered

to have finite useful lives. They are recognised at acqui-