BMW 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55 COMBINED MANAGEMENT REPORT

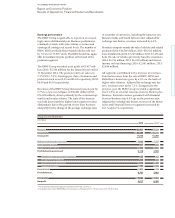

Germany, China and South Africa with a total volume

equivalent to € 2.7 billion. Further funds were also raised

via new ABS conduit transactions in Brazil, Canada,

and Japan totalling € 0.8 billion. Other existing

trans-

actions remained in place in Switzerland, the UK, Korea

and Australia.

The regular issue of commercial paper also strengthens

the BMW Group’s financial basis. The following table

provides an overview of amounts utilised at 31

Decem-

ber

2014 in connection with the BMW Group’s money

and

capital market programmes:

accounted for using the equity method (70.5 %), deferred

tax assets (27.2 %) and intangible assets (5.2 %). At the

same time, financial assets decreased by 21.9 %.

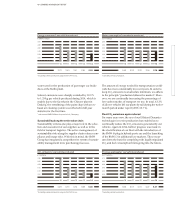

Within current assets, increases were registered in par-

ticular for receivables from sales financing (9.7 %), in-

ventories (15.6 %), other assets (18.3 %) and current tax

(65.6 %). Trade receivables went down by 12.1 %.

The growth in business reported by the Financial Ser-

vices segment is reflected in increases of € 2,085 million

and € 4,822 million in current and non-current receiv-

ables from sales financing respectively and in the higher

level of leased products (up by € 4,251 million).

Non-current receivables from sales financing accounted

for 24.2 % (2013: 23.6 %) of total assets, current receiv-

ables from sales financing for 15.2 % (2013: 15.5 %). Total

receivables from sales financing relate to retail customer

and dealer financing (€ 45,849 million) and finance leases

(€ 15,175 million). Adjusted for exchange rate factors,

non-current receivables from sales financing grew by

9.1 %, while current receivables from sales financing

went up by 4.8 %. The currency impact was mainly at-

tributable to the appreciation in the value of a number

of currencies against the euro, most notably the US dol-

lar, the British pound and the Chinese renminbi.

At the end of the reporting period, leased products

accounted for 19.5 % of total assets, above their level

one year earlier (18.7 %). Adjusted for exchange rate

factors, leased products went up by 10.2 %.

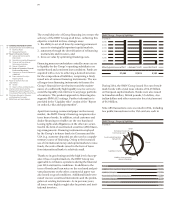

Property, plant and equipment increased by € 2,014 mil-

lion compared to the previous year. The main focus in

2014 was on product investments for production start-

ups (including the BMW 2 Series Active Tourer, the

7 Series Sedan and the 2 Series Gran Tourer) and infra-

structure improvements. In total, € 4,539 million (2013:

€ 4,494 million) was invested, most of which related

to the Automotive segment. Depreciation on property,

plant and equipment totalled € 2,924 million (2013:

€ 2,494 million). At 31 December 2014, property, plant

and equipment accounted for 11.1 % of total assets

(2013:

11.0 %). Adjusted for exchange rate factors, property,

plant and equipment increased by 10.8 %. Capital com-

mitments for the acquisition of items of property, plant

The BMW Group’s liquidity position is extremely robust,

with liquid funds totalling € 11.7 billion on hand at 31 De-

cember

2014. The BMW Group also has access to a

syndicated credit line of € 6 billion, with a term up to

October 2018. This credit line, which is provided on

attractive conditions by a consortium of 38 international

banks, had not been utilised at the end of the reporting

period.

Further information with respect to financial liabilities

is provided in notes 35, 39 and 43 to the Group Finan-

cial Statements.

Net assets position*

The Group balance sheet total increased by € 16,426 mil-

lion (11.9 %) compared to the end of the previous finan-

cial year to stand at € 154,803 million at 31 December

2014. Adjusted for exchange rate factors, the balance

sheet total increased by 7.5 %.

On the assets side of the balance sheet, the increase in

non-current assets related primarily to receivables

from sales financing (14.8 %), leased products (16.4 %),

property, plant and equipment (13.3 %), investments

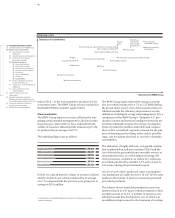

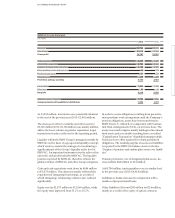

Programme Amount utilised

in € billion

Euro Medium Term Notes 30.9

Australian Medium Term Notes –

Commercial paper 6.1

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.