BMW 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

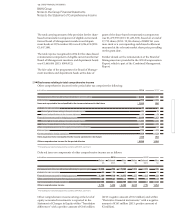

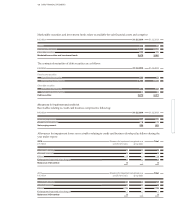

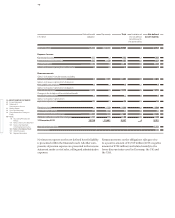

2013 Allowance for impairment recognised on a Total

in € million specific item basis group basis

Balance at 1 January 1,268 411 1,679

Allocated / reversed 194 104 298

Utilised – 302 – 15 – 317

Exchange rate impact and other changes – 61 – 19 – 80

Balance at 31 December 1,099 481 1,580

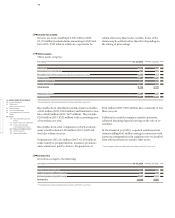

At the end of the reporting period, impairment allow-

ances

of € 515 million (2013: € 481 million) were

recog-

nised on a group basis on gross receivables from sales

financing totalling € 38,780 million (2013*: € 33,740 mil-

lion). Impairment allowances of € 1,000 million (2013:

€ 1,099 million) were recognised at 31 December 2014

on a specific item basis on gross receivables from sales

financing totalling € 12,951 million (2013: € 12,211 mil-

lion).

Receivables from sales financing which were not over-

due at the end of the reporting period amounted to

€ 10,808 million (2013*: € 9,746 million). No impairment

losses were recognised for these balances.

The estimated fair value of collateral received for receiv-

ables on which impairment losses were recognised to-

talled € 25,443 million (2013: € 23,689 million) at the end

of the reporting period. This collateral related primarily

to vehicles. The carrying amount of assets held as col-

lateral

and taken back as a result of payment default

amounted to € 41 million (2013: € 30 million).

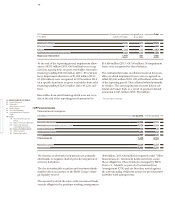

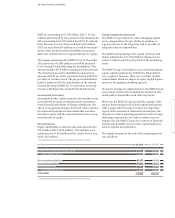

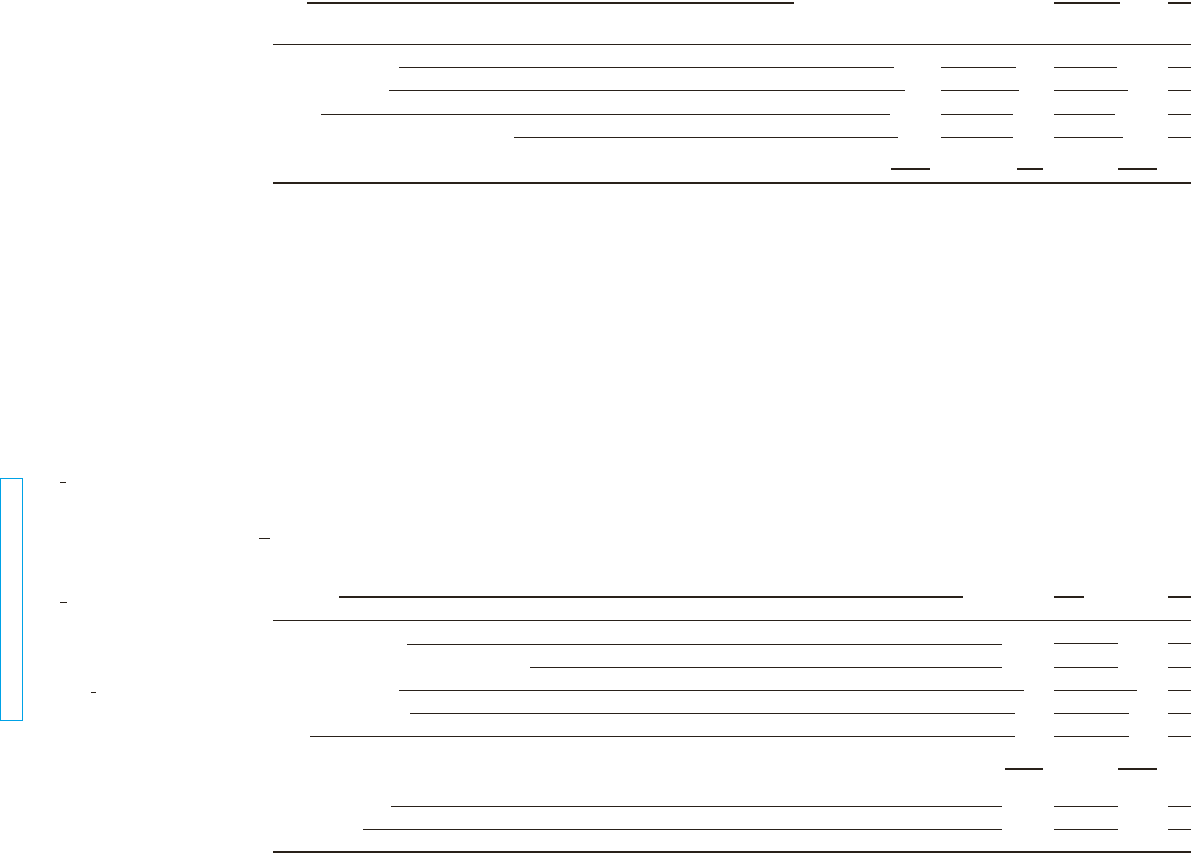

in € million 31. 12. 2014 31. 12. 2013

Derivative instruments 2,888 4,013

Marketable securities and investment funds 3,972 3,060

Loans to third parties 12 32

Credit card receivables 239 222

Other 297 825

Financial assets 7,408 8,152

thereof non-current 2,024 2,593

thereof current 5,384 5,559

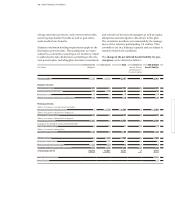

29

Financial assets

Financial assets comprise:

The decrease in derivative instruments was primarily

attributable to negative market price developments of

currency derivatives.

The rise in marketable securities and investment funds

mainly reflects an increase in the BMW Group’s strate-

gic liquidity reserve.

The amount by which the value of the investment funds

exceeds obligations for part-time working arrangements

(€ 48 million; 2013: € 44 million) is reported under “Other

financial assets”. Investment funds are held to secure

these obligations. These funds are managed by BMW

Trust e. V., Munich, as part of a Contractual Trust

Arrange ment (CTA) and are therefore netted against

the corresponding settlement arrears for pre-retirement

part-time work arrangements.

* Prior year figures amended.