Asus 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.85

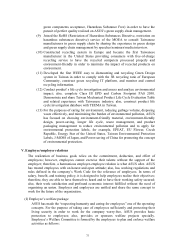

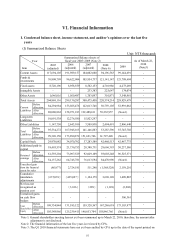

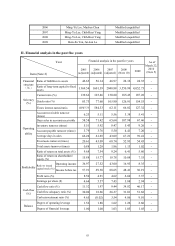

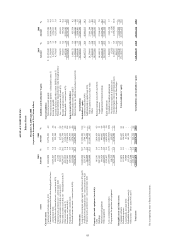

(1) Current ratio = Current assets / current liability

(2) Quick ratio = (Current assets – Inventory – Prepaid expense) / Current liability

(3) Times interest earned ratio = Net income before tax and interest expense / Interest expense

of the year

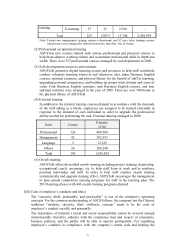

3. Operating ability

(1) Account receivable turnover (including accounts receivable and notes receivable derived

from business operation) = Net sales / Average accounts receivable (including accounts

receivable and notes receivable derived from business operation)

(2) Days sales in accounts receivable = 365 / Account receivable turnover

(3) Inventory turnover = Cost of goods sold / Average inventory amount

(4) Account payable turnover (including accounts payable and notes payable derived from

business operation) = Cost of goods sold/ Average accounts payable (including accounts

payable and notes payable derived from business operation)

(5) Average days in sales = 365 / Inventory turnover

(6) Fixed assts turnover = Net sales / Net fixed assets

(7) Total assets turnover = Net sales / Total assets

4. Profitability

(1) Return on assets = [Net income (loss) + interest expense x (1-tax rate)] / Average total assets

(2) Return on shareholder’ s equity = Net income (loss) / Net average shareholders’ equity

(3) Ratio to issued capital stock = Net income before tax / Issued capital stock

(4) Profit ratio = Net income (loss) / Net sales

(5) Earnings per share = (Net income – preferred stock dividend) / Weighted average stock

shares issued

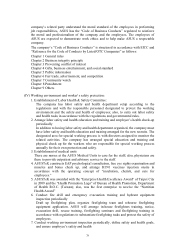

5. Cash flow

(1) Cash flow ratio = Net cash flow from operating activity / Current liability

(2) Cash flow adequacy ratio = Net cash flow from operating activity in the past five years /

(Capital expenditure + Inventory increase + Cash dividend) in the past five years

(3) Cash reinvestment ratio = (Net cash flow from operating activity – Cash dividend) / (Fixed

assets + Long-term investment + Other assets + Working capital)

6. Balance:

(1) Degree of operating leverage = (Net operating income – Variable operating cost and expense)

/ Operating income

(2) Degree of financial leverage = Operating income / (Operating income – interest expense)

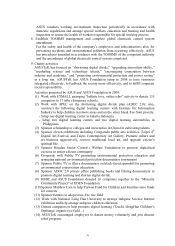

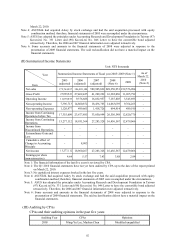

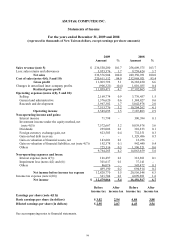

Note 7: The following factors are to be included for consideration for the calculation of earnings per

share:

1. It is based on the weighted average common stock shares instead of the outstanding stock shares

at yearend.

2. For capitalization with cash or Treasury stock trade, the stock circulation must be included for

consideration to calculate weighted average stock shares.

3. For capitalization with retained earnings and additional paid-in capital, the earnings per share

calculated semi-annually and annually must be adjusted retroactively and proportionally to the

capitalization but without considering the issuance period of the capitalization.

4. If preferred stock shares are nonconvertible and cumulative, the dividend of the year (whether it

is distributed or not) should be deducted from net income or added to the net loss. If preferred

stock shares are not cumulative, preferred stock dividend should be deducted from net income if

there is any but it needs not be added to net loss if there is any.

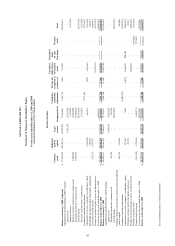

Note 8: The following factors are to be included for consideration for the analysis of cash flow:

1. Net cash flow from operating activity meant for the net cash inflow from operating activity on

the Statement of Cash Flow.

2. Capital expenditure meant for the cash outflow of capita investment annually.