Asus 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.104

8

ASUSTEK COMPUTER INC.

Notes to Financial Statements

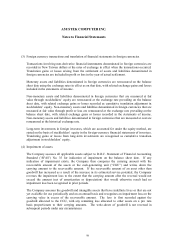

Deferred income tax assets or liabilities are classified as current or non-current based on the

classification of items that resulted in the deferred item or based on the timing of the expected

reversal, for certain transactions not directly related to an asset or liability.

The 10% additional income tax on unappropriated earnings is recorded as current income tax

expense in the following year when the shareholders resolve not to distribute the earnings.

Current income tax is the higher of current income tax payable or the Alternative Minimum Tax

(“AMT”) calculated by applying the Income Basic Tax Act (“IBTA”). The Company has taken

into consideration the impact of the AMT in the determination of its current income tax expense

and its future impact when estimating the realizable value of the deferred tax assets.

(16) Treasury stock

The Company adopts R.O.C. SFAS No. 30 “Accounting for Treasury Stocks” to account for

treasury stock transaction and recognizes the treasury stock at purchase cost. A gain on the sale of

treasury stock is credited to additional paid-in capital – treasury stock. Losses are charged to

additional paid-in capital, but only to the extent of available net gains from previous sales or

retirements of the same class of stock; otherwise, losses are charged to retained earnings. The

cost of treasury stock is computed using the weighted-average method.

When treasury stock is retired, the weighted-average cost of the retired treasury stock is written off

against the par value of the shares and the paid-in capital derived from the issuance of shares in

excess of par value. If the weighted-average cost written off exceeds the sum of the par value and

the paid-in capital in excess of par value, the difference is debited to additional paid-in capital –

treasury stock arising from the same class of stock or to retained earnings, and if vice versa, the

difference is credited to additional paid-in capital – treasury stock.

(17) Earnings per share

Earnings per share of common stock are computed based on the weighted-average number of

common shares outstanding during the period. Earnings per share for the prior period are

retroactively adjusted to reflect the effects of new shares issued by transferring additional paid-in

capital, retained earnings, and employees’ bonuses approved in the annual stockholders’ meetings

held before and in 2008.

The convertible bonds and employee stock bonuses which have not yet been approved in the

stockholders’ meeting are potential common shares. Only basic earnings per share are disclosed

if there is no dilution effect. Otherwise, both basic and diluted earnings per share are disclosed.

For the purpose of calculating diluted earnings per share, the potential common shares are deemed

to have been converted into common stock at the beginning of the period, and the effect on net

income of the additional common shares outstanding is considered accordingly.