Asus 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136

See accompanying notes to financial statements.

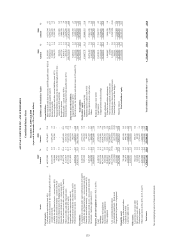

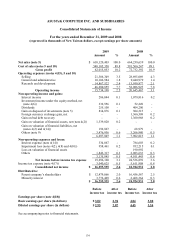

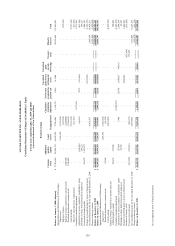

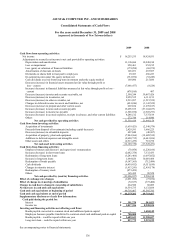

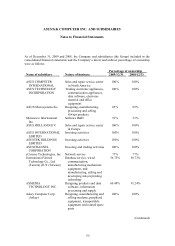

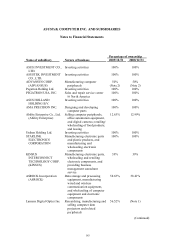

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the years ended December 31, 2009 and 2008

(expressed in thousands of New Taiwan dollars)

2009 2008

Cash flows from operating activities:

Net income $ 16,255,535 18,924,931

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization 13,126,684 10,248,180

Loss on impairment 958,461 952,215

Loss (gain) on valuation of financial liabilities (179,298) (68,979)

Amortization of discount on bonds 128,051 267,507

Dividends on shares held in trust paid to employees 69,383 286,223

Investment income under the equity method, net (332,956) (52,249)

Cash dividends received from long-term investment under the equity method 169,090 215,686

Decrease (increase) in financial assets measured at fair value through profit or

loss – current (7,688,477) (8,529)

Increase (decrease) in financial liabilities measured at fair value through profit or loss –

current (878,100) 407

Decrease (increase) in notes and accounts receivable, net 2,509,244 39,887,426

Decrease (increase) in inventories, net 9,959,535 6,131,153

Decrease (increase) in other receivables, net 2,533,997 (1,515,552)

Changes in deferred income tax assets and liabilities, net (401,246) (1,143,529)

Decrease (increase) in prepaid and other current assets 669,654 (1,239,187)

Increase (decrease) in notes and accounts payable 13,698,535 (57,104,837)

Increase (decrease) in income tax payable (1,588,938) (1,905,273)

Increase (decrease) in accrued expenses, receipts in advance, and other current liabilities 4,248,512 7,375,619

Others 272,748 214,946

Net cash provided by operating activities 53,530,414 21,466,158

Cash flows from investing activities:

Acquisition of investments (1,639,421) (2,540,579)

Proceeds from disposal of investments (including capital decrease) 2,429,591 1,666,225

Decrease (increase) in refundable deposits 407,040 (40,307)

Acquisition of property, plant and equipment (7,844,366) (12,689,532)

Additions to deferred expenses and intangible assets (2,628,735) (4,643,036)

Other assets and others (2,913,479) 718,758

Net cash used in investing activities (12,189,370) (17,528,471)

Cash flows from financing activities:

Employee bonuses and directors’ and supervisors’ remuneration (70,958) (1,220,106)

Increase (decrease) in short-term loans (2,082,754) 7,332,433

Redemption of long-term loans (3,243,466) (1,097,852)

Increase in long-term loans 1,698,826 10,001,484

Redemption of bonds payable (9,147,365) (712,499)

Cash dividends (8,439,852) (9,351,630)

Changes in minority interest (1,913,241) (2,456,178)

Redemption of treasury stock (873,459) -

Others 165,432 90,528

Net cash provided by (used in) financing activities (23,906,837) 2,586,180

Effect of exchange rate changes (1,091,395) (75,872)

Effect of change in ownership of subsidiaries (72,657) (375,400)

Change in cash due to change in ownership of subsidiaries 264,580 60,089

Net increase in cash and cash equivalents 16,534,735 6,132,684

Cash and cash equivalents at beginning of period 49,718,467 43,585,783

Cash and cash equivalents at end of period $ 66,253,202 49,718,467

Supplementary disclosures of cash flow information:

Cash paid during the period for:

Interest $ 391,270 501,023

Income tax $ 5,017,356 8,908,524

Investing and financing activities not affecting cash flows:

Bonds payable converted to common stock and additional paid-in capital $ - 1,484,149

Employee bonuses payable transferred to common stock and additional paid-in capital $ 700,000 -

Bonds payable – could be repaid within one year $ 3,609,633 11,988,037

Long-term loan – could be repaid within one year $ 837,772 2,219,239