Asus 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

ASUSTEK COMPUTER INC.

Notes to Financial Statements

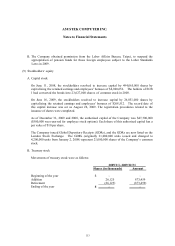

A. In order to enhance competitiveness and boost productivity, the Company’ s shareholders

resolved, on October 30, 2007, to restructure the Company’ s businesses into own-brand and

OEM. The date of the spin-off was January 1, 2008. Pursuant to the resolution, the

Company transferred its computer OEM business with estimated value of $70,000,000 to its

newly established subsidiary PEGATRON by subscribing 1,600,000,000 newly issued shares of

PEGATRON at $43.75 (dollars) per share. In addition, the Company transferred its non-

computer OEM business and machine hull and molding tool R&D business with estimated

value of $12,000,000 to its newly established subsidiary UNIHAN by subscribing 800,000,000

newly issued shares of UNIHAN at $15 (dollars) per share. The plan was approved by the

relevant authorities. The registration of changes was completed in January 2008. The assets

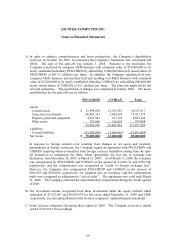

and liabilities for the spin-off were as follows:

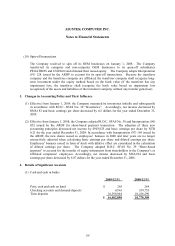

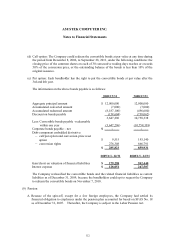

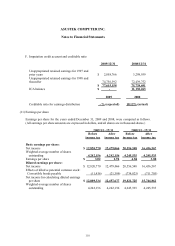

PEGATRON UNIHAN Total

Assets

Current assets $ 21,999,830 12,555,287 34,555,117

Long-term investments 66,867,161 7,060,209 73,927,370

Property, plant and equipment 4,761,981 127,143 4,889,124

Other assets 353,066 126,822 479,888

93,982,038 19,869,461 113,851,499

Liabilities

Current liabilities (23,982,038) (7,869,461) (31,851,499)

Net Assets $ 70,000,000 12,000,000 82,000,000

In response to foreign currency risk resulting from changes in net assets and inventory

denominated in foreign currencies, the Company signed an agreement with PEGATRON and

UNIHAN requiring whoever benefited from foreign currency translation arising from the spin-

off transaction to compensate the other, where appropriate, for loss due to exchange rate

fluctuation, from December 28, 2007, to March 31, 2008. As of March 31, 2008, the Company

was compensated by PEGATRON and UNIHAN in the amount of $1,602,711 and $255,748,

respectively, and the compensation was recognized as “credit to foreign exchange loss”.

However, the Company also compensated PEGATRON and UNIHAN in the amount of

$365,523 and $109,050, respectively, for valuation loss on inventory, and the compensation

made was recognized as adjustment to “cost of sales”. The agreement was valid until March

31, 2008. The Company collected the aforementioned compensation during the fourth quarter

of 2008.

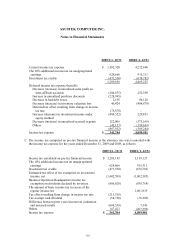

B. The investment income recognized from these investments under the equity method which

amounted to $7,572,667 and $9,039,978 for the years ended December 31, 2009 and 2008,

respectively, was determined based on the investee companies’ audited financial statements.

C. Some investee companies decreased their capital in 2009. The Company received a capital

refund of $5,093,110 accordingly.