Asus 2009 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

172

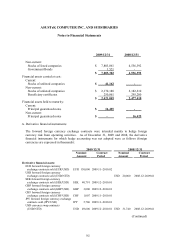

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Notes to Financial Statements

(Continued)

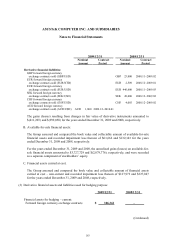

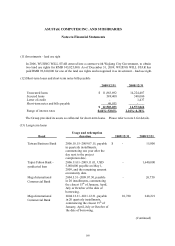

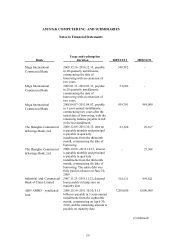

month based on the consolidated semi-annual and annual financial statements, and anytime the

bank considers necessary. Askey was in compliance with the above covenants in 2009 and 2008.

B. Askey was the guarantor for the loan payable by Leading Profit Co., Ltd. Therefore, Askey has

covenanted that the total percentage of the direct and indirect ownership of Askey by the

Company and its related companies should exceed 67% of Askey’ s ownership.

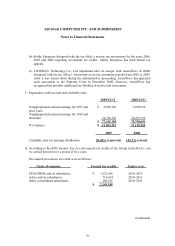

C. According to the loan agreements, PEGATRON must comply with the following financial

covenants until its entire loan is fully paid. The calculations of the following financial ratios

should be based on audited annual consolidated financial statements and reviewed semi-annual

consolidated financial statements of PEGATRON that are approved by management of the bank.

(i) Current ratio (current assets/current liabilities): should be no less than 100%.

(ii) Debt ratio ((total liabilities + contingent liabilities)/tangible net assets): should not be higher

than 50%.

(iii) Interest coverage ratio (EBITDA/interest expenses): should be no less than 400%.

(iv) Tangible net assets (stockholders equity (including minority shareholders) – intangible

assets): should not be less than $90,000,000.

D. PEGATRON has provided promissory note as collateral for the unsecured loans.

E. Please refer to Note 6 for details regarding the assets pledged as collateral.

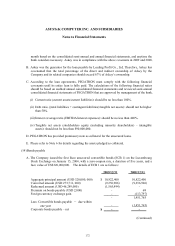

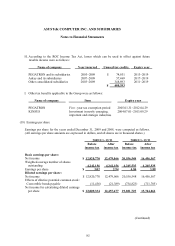

(14)Bonds payable

A. The Company issued the first Euro unsecured convertible bonds (ECB 1) on the Luxembourg

Stock Exchange on January 15, 2004, with a zero-coupon rate, a duration of five years, and a

face value of US$320,000,000. The details of ECB 1 are as follows:

2009/12/31 2008/12/31

Aggregate principal amount (USD 320,000, 000) $ 10,822,400 10,822,400

Converted amount (USD 273,711, 000) (9,256,906) (9,256,906)

Redeemed amount (USD 46,289,000) (1,565,494) -

Premium on bonds payable (USD 2,000) - 68

Foreign currency exchange gain - (113,797)

- 1,451,765

Less: Convertible bonds payable - due within

one year - (1,451,765)

Corporate bonds payable – net $ - -