Asus 2009 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

180

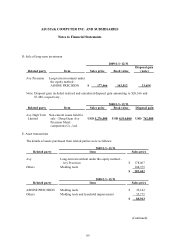

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Notes to Financial Statements

(Continued)

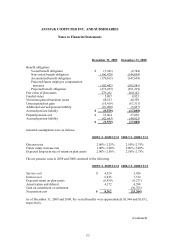

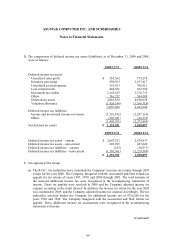

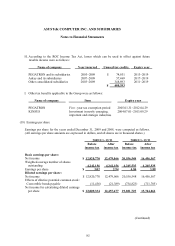

D. The components of deferred income tax assets (liabilities) as of December 31, 2009 and 2008,

were as follows:

2009/12/31 2008/12/31

Deferred income tax assets:

Unrealized sales profit $ 283,562 179,278

Inventory provisions 890,363 1,197,417

Unrealized accrued expense 523,103 790,511

Loss carryforward 480,393 362,390

Investment tax credits 2,145,185 1,576,753

Others 561,232 544,309

Deferred tax assets 4,883,838 4,650,658

Valuation allowance (1,828,144) (1,366,318)

3,055,694 3,284,340

Deferred income tax liabilities:

Income and investment income (overseas) (1,518,182) (2,247,110)

Others (385,581) (26,333)

(1,903,763) (2,273,443)

Net deferred tax assets $ 1,151,931 1,010,897

2009/12/31 2008/12/31

Deferred income tax assets – current $ 2,607,912 2,829,817

Deferred income tax assets – non-current 245,995 427,640

Deferred income tax liabilities – current (415) (16,971)

Deferred income tax liabilities – non-current (1,701,561) (2,229,589)

$ 1,151,931 1,010,897

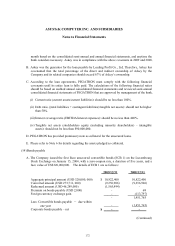

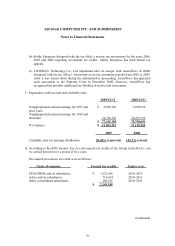

E. Tax appeals of the Group:

(a) The R.O.C. tax authorities have examined the Company’ s income tax returns through 2007

except for the year 2006. The Company disagreed with the assessment and filed formal tax

appeals for tax returns of years 1997, 1999, and 2000 through 2002. The total amounts of

the assessed additional income tax were recognized in the accompanying statements of

income. These tax appeals were resolved in 2009 and the Company adjusted income tax

expense according to the result thereof. In addition, the income tax return for the year 2005

was examined in 2009, and the Company adjusted income tax expense accordingly. The tax

authorities assessed further the Company for additional income tax of $716,266 for the

years 1996 and 1998. The Company disagreed with the assessment and filed formal tax

appeals. These additional income tax assessments were recognized in the accompanying

statements of income.