Asus 2009 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.157

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Notes to Financial Statements

(Continued)

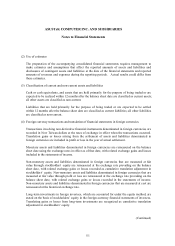

(15) Convertible bonds payable

According to R.O.C. SFAS No. 36 “Financial Instruments: Disclosure and Presentation” and

Interpretation (95) 078 by the Accounting Research and Development Foundation (ARDF),

convertible bonds with a put option issued by the Group before December 31, 2005, are accounted

for in accordance with SFAS No. 21. The derivative instrument embedded in a non-derivative host

debt instrument is not separated from the equity component of the instrument. Costs incurred for

the issuance of redeemable convertible bonds are deferred and amortized during the period

between the issuance date and the last redeemable date.

Bonds issued after January 1, 2006, are accounted for in accordance with R.O.C. SFAS No. 36 and

Interpretations (95) 290, (97) 331 and (98) 046 by the ARDF as follows:

A. The issuance costs are allocated to the related liability and equity components in proportion of

the initially recognized amounts.

B. Convertible bonds bearing a clause on conversion price adjustment based on stock market price

do not include the equity component. For the liability components, the fair value of the

conversion right and call/put option is determined firs; then the book value of main debt

component is determined based on the net amount of the issuance price after deducting the fair

value of the call/put option and conversion right with a clause on price adjustment.

C. Convertible bonds are subsequently measured at amortized cost. Derivatives with call/put

options and conversion rights with a clause on price adjustment are recognized as “financial

liabilities at fair value through profit or loss” and are subsequently measured at fair value.

Movements in the fair value of the derivatives are recognized as “gain/ (loss) on valuation of

financial liabilities”.

D. If the bondholder exercises the right to convert the bonds ahead of the maturity date of the

bonds, the book value of the liability component i s a d j u s t e d to the value on the conversion

date, which serves as the basis for the recording of the issuance of common stock so that no

conversion gain and loss is recognized thereon.

E. If the bondholder is eligible to exercise the put option within one year, the bonds payable are

reclassified as current liability. When the put option expires, those bonds payable are reclassified

as long-term liability if the liability meets the definition of long-term liability.

(16) Retirement plan

The Company and domestic subsidiaries make monthly contributions to the pension fund at 2% of

the total monthly salaries and wages as required by the Labor Standards Law. The fund is

administrated by the Employees Retirement Fund Committee. This pension fund is considered

absolutely separate from the Company after contribution; therefore, it is not included in the

accompanying financial statements.