Asus 2009 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.186

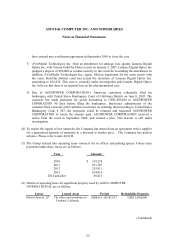

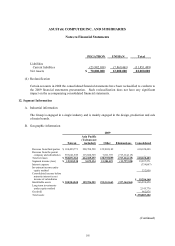

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Notes to Financial Statements

(Continued)

(ii) The open-end funds & stocks of listed companies held by the Company are classified as

financial assets measured at fair value through profit or loss and available-for-sale

financial assets. As these assets are measured at fair value, the Group has risk

exposure related to changes in fair value in an equity securities market.

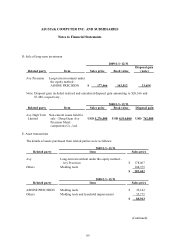

(b) Credit risk

(i) Credit risk means the potential loss of the Group if the counterpart involved in that

transaction defaults. Since the Group’ s derivative financial instrument agreements are

entered into with financial institutions with good credit ratings, management believes

that there is no significant credit risk from these transactions.

(ii) The primary potential credit risk is from financial instruments like cash, bank deposits,

equity securities under non-equity method, and accounts receivable. The Group

deposits cash in different financial institutions. Equity securities under non-equity

method were funds and listed stock issued by companies with good credit ratings.

The Group manages credit risk exposure related to each financial institution and

believes that there is no significant concentration of credit risk of cash and equity

securities. As the customers of the Group have good credit and profit records, the

Group is able to evaluate the financial conditions of these customers in order to reduce

credit risk of accounts receivable.

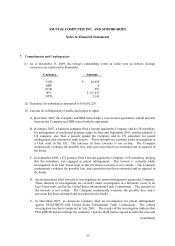

(c) Liquidity risk

(i) The Group’ s objective is to maintain a balance of funding continuity and flexibility

through the use of financial instruments such as cash and cash in bank, and bonds

payable.

(ii) The open-end funds & stocks of listed companies held by the Company have publicly

quoted prices and could be sold at the approximate market price. As to the forward

exchange contracts, there are no significant financing risks due to expected sufficient

capital. Management believes that the cash flow risk is not significant because

contracted foreign currency exchange rates are fixed.

(iii) Equity investments recorded as financial assets carried at cost do not have reliable

market prices and are expected to have liquidity risk.

(iv) The derivative financial instruments for hedging are intended mainly to hedge the

exchange rate risk from future cash flows. The forward contracts’ duration corresponds

to the Group’ s foreign currency future cash flows. The Group will settle the foreign

currency liabilities at expiration of the contracts. Thus, management believes that the

cash flow risk is not significant.