Asus 2009 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

204

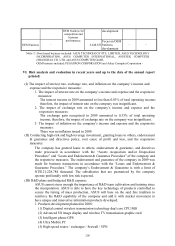

VIII. Special disclosures

I. Related party

(II) Consolidated financial statements of the related party

1. Related party

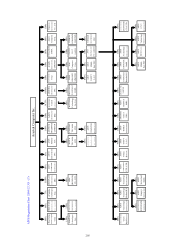

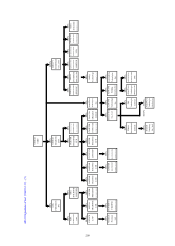

(1) Organizational structure of related party: Please refer to Page 205-209.

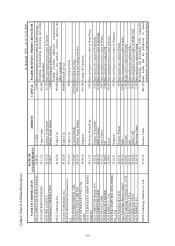

(2) Company profile of related party: Please refer to Page 210-217.

(3) A controlling and hierarchical relationship according to Article 369.3 of Company

Law: None

(4) Business scope of ASUS Group:

The business scope of ASUS and the related party includes computer-related product

design, production, processing, and sales. Some related parties are in the business of

investment. In general, the collaboration within the organization is to generate the

best result through reciprocal support in technology, production, marketing, and sales.

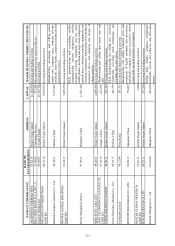

(5) Directors, supervisors, and president of the related party: Please refer to Page

218-225.

2. Business operation of the related party: Please refer to Page 226-233.

(II) Consolidated financial statements of the related party: Please refer to Page 131-196.

(III) Related Party Report: N/A

II. Subscription of marketable securities privately in the most recent years and up to the

date of the report printed: None

III. The stock shares of the company held or disposed by the subsidiaries in the most recent

years and up to the date of the report printed: None

IV. Supplementary disclosures: None

V. Occurrence of events defined in Securities Transaction Law Article 36.2.2 that has great

impact on shareholder’s equity or security price in the most recent years and up to the

date of the report printed:

The Company held its extraordinary shareholders’ meeting on February 9, 2010, and passed a

resolution for the spin-off of its ODM business. Such resolution requires the Company to

spin off the ODM assets and business (the Company's 100%-owned long-term equity

investment in Pegatron) to the Company's wholly owned existing subsidiary Pegatron

International Investment Co., Ltd. Pegatron International Investment Co., Ltd. will issue new

shares to the Company and the shareholders of the Company as consideration. The

Company will have a capital reduction of $36,097,609 or a capital reduction of approximately

85%. It is expected that the Company will acquire approximately 25% of the equity in

Pegatron International Investment Co., Ltd. and that the shareholders of the Company will in

total acquire approximately 75% of the equity in Pegatron International Investment Co., Ltd.

The spin-off date is expected to be June 1, 2010.