Asus 2009 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.159

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Notes to Financial Statements

(Continued)

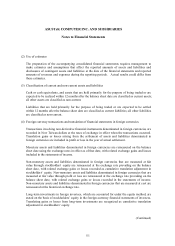

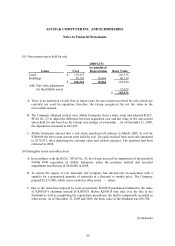

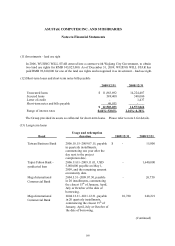

(19) Income taxes

Income tax is calculated on the basis of accounting income. The differences between the tax

bases and the book values of assets and liabilities are recorded as deferred tax using the enacted tax

rates for the periods in which the deferred tax is expected to be reversed. The tax effects from

taxable temporary differences are recognized as deferred tax liability, while the deductible

temporary differences, loss carryforward and tax credits are accounted for as deferred tax assets,

which are assessed an allowance for deferred tax assets based on future realization.

Deferred income tax assets or liabilities are classified as current or non-current based on the

classification of items that resulted in the deferred assets or liabilities or, based on the timing of the

expected reversal for certain transactions not directly related to an asset or liability.

Investment tax credits are accounted for using the flow-through method. Therefore, deferred

income tax credits generated from purchases of machinery and equipment and production

technology, development and research expenses, and human resource training expenses are

recognized in the year in which the credit arises.

The 10% additional income tax on unappropriated earnings of the Company and domestic

subsidiaries is recorded as current income tax expense in the following year when the shareholders

resolve not to distribute the earnings.

Current income tax is the higher of current income tax payable or the Alternative Minimum Tax

(“AMT”) calculated by applying the Income Basic Tax Act (“IBTA”). The Company and

domestic subsidiaries have taken into consideration the impact of the AMT in the determination of

their current income tax expense and its future impact when estimating the realizable value of the

deferred tax assets.

The income tax for each consolidated entity is reported on an individual basis with the

relevant country and is not reported on a consolidated basis. The consolidated income tax

expense is the total of income tax expenses for all consolidated entities.

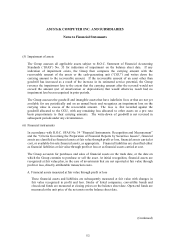

(20) Treasury stock

The Company adopts R.O.C. SFAS No. 30 “Accounting for Treasury Stocks” to account for

treasury stock transaction and recognizes the treasury stock at purchase cost. A gain on the sale of

treasury stock is credited to additional paid-in capital – treasury stock. Losses are charged to

additional paid-in capital, but only to the extent of available net gains from previous sales or

retirements of the same class of stock; otherwise, losses are charged to retained earnings. The

cost of treasury stock is computed using the weighted-average method.