Asus 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

97

(Continued)

ASUSTeK COMPUTER INC.

Notes to Financial Statements

December 31, 2009 and 2008

(expressed in thousands of New Taiwan dollars unless otherwise specified)

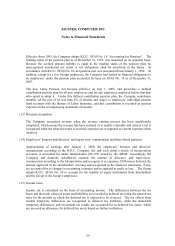

1. Organization

ASUSTeK Computer Inc. (the Company) was established on April 2, 1990. The Company’ s

common shares were listed on the Taiwan Stock Exchange (TSE). Its main activities are to produce,

design and sell notebook PCs, main boards, CD-ROMs and add-on cards.

The Company resolved to spin-off its OEM businesses on January 1, 2008. Pursuant to the Company’ s

resolution, the Company transferred its computer and non-computer OEM businesses to its spun-off

subsidiaries PEGATRON CORPORATION (PEGATRON) and UNIHAN CORPORATION

(UNIHAN), respectively.

The Company’ s headcounts aggregated 3,455 and 3,933 as of December 31, 2009 and 2008,

respectively.

2. Summary of Significant Accounting Policies

The financial statements are prepared in accordance with the Guidelines Governing the Preparation of

Financial Reports by Securities Issuers, the Business Accounting Law, the Criteria Governing

Handling of Commercial Accounting, and accounting principles and practices generally accepted in

the Republic of China. The significant accounting policies and measurement basis adopted in

preparing the accompanying financial statements are as follows:

(1) Use of estimates

The preparation of the accompanying financial statements requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosures of

contingent assets and liabilities at the date of the financial statements and reported amounts of

revenues and expenses during the reporting periods. Actual results could differ from these

estimates.

(2) Classification of current and non-current assets and liabilities

Cash or cash equivalents, and assets that are held primarily for the purpose of being traded or are

expected to be realized within 12 months after the balance sheet date are classified as current assets;

all other assets are classified as non-current.

Liabilities that are held primarily for the purpose of being traded or are expected to be settled

within 12 months after the balance sheet date are classified as current liabilities; all other liabilities

are classified as non-current.