Asus 2009 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

153

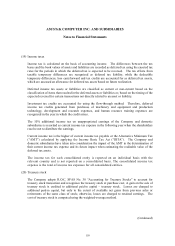

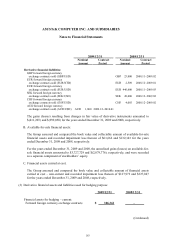

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Notes to Financial Statements

(Continued)

B. Financial assets carried at cost

Equity investments without reliable market prices, including emerging and other unlisted stocks,

are measured at cost. If objective evidence of impairment exists, the Group recognizes

impairment loss, which is not reversed in subsequent periods.

C. Available-for-sale financial assets

Available for sale financial assets are those non-derivative financial assets that are designated as

available for sale or not classified as financial assets at fair value through profit or loss, held-to-

maturity financial assets, or loans and receivables. These assets are then measured at fair

value. The gain or loss arising from change in fair value, excluding impairment loss and

exchange gain or loss from the translation of monetary financial assets denominated in foreign

currencies, is recognized in a separate component of stockholders’ equity until such investment

is reclassified or disposed of, upon which the cumulative gains or losses previously charged to

stockholders’ equity are transferred to the current profit or loss.

D. Financial assets held to maturity

Debt securities for which the Company has a positive intention and ability to hold to maturity

are classified as financial assets held to maturity and are carried at amortized cost under the

effective interest method. If objective evidence of impairment exists, the Group recognizes

impairment loss. If, in a subsequent period, the impairment loss decreases and the decrease is

clearly attributable to an event which occurred after the impairment loss was recognized, the

previously recognized impairment loss is reversed to the extent of the decrease. The reversible

amount may not exceed the amortized cost that would have been determined if no impairment

loss had been recognized.

E. Derivative financial assets and liabilities for hedging

The Group recognizes the offsetting effects on profit or loss of changes in the fair values of the

hedging instrument and the hedged item when hedging relationships meet the criteria for hedge

accounting which is accounted for as follows:

(a) Fair value hedge: Changes in the fair value of a hedging instrument designated as a fair

value hedge are recognized in current profit or loss. The hedged item also is stated at fair

value in respect of the risk being hedged, with any gain or loss being recognized in current

profit or loss.