Asus 2009 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

177

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Notes to Financial Statements

(Continued)

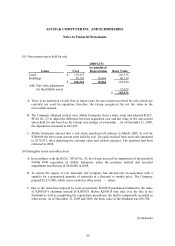

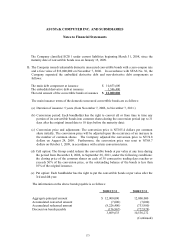

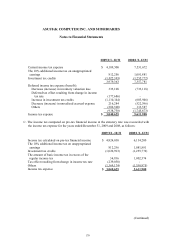

C. Additional paid-in capital

Pursuant to the Company Act, additional paid-in capital can only be used to offset a deficit or to

increase common stock. Cash dividends cannot be declared out of additional paid-in capital.

According to the Regulations Governing the Offering and Issuance of Securities by Securities

Issuers, capital increases through the capitalization of paid-in capital in excess of par value

should not exceed 10% of total common stock outstanding. In addition, capital increases

through the capitalization of paid-in capital in excess of par value can only commence in the

year following the initial year.

As of December 31, 2009 and 2008, due to the non-proportional investment in investee’ s

increase in capital, additional paid-in capital amounting to $1,963,105 and $1,835,145,

respectively, was recognized, in accordance with SFAS. As this additional paid-in capital is

not regulated by the R.O.C. Company Act, Article 241, the transfer thereof to retained earnings

is prohibited.

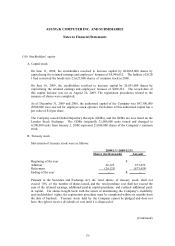

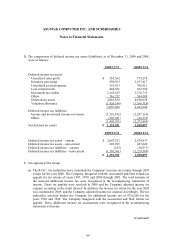

D. Limitation on distribution of retained earnings

According to the Company’ s articles of incorporation, annual net income after making up prior

years' losses, if any, should be distributed as follows: 10% as legal reserve, an appropriate

amount as special reserve according to relevant regulation or as required by the government,

10% of capital stock as capital interest, no less than 1% as employees’ bonuses, and no more

than 1% as directors’ and supervisors’ bonuses. When the employees’ bonuses are distributed

in stock, the recipients must include the employees of subsidiaries. After the distribution of

earnings, the remained earnings, if any, may be appropriated according to a resolution adopted

in a stockholders’ meeting.

The Company is facing a rapidly changing industrial environment, with the life cycle of the

industry in the growth phase. In light of the long-term financial plan of the Company and the

demand for cash by the stockholders, the Company should distribute cash dividends of no less

than 10% of the aggregate of all dividends.

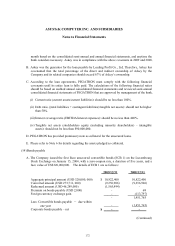

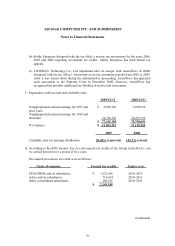

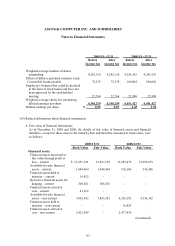

E. Based on the resolutions approved by the stockholders during their annual stockholders’

meetings on June 16, 2009, and June 11, 2008, the employees’ bonuses and directors’ and

supervisors’ remuneration were appropriated from the distributable retained earnings of 2008

and 2007 as follows:

2008 2007

Employees’ bonuses – cash $ 250,837 912,030

Employees’ bonuses – stock (note) 700,000 1,200,000

Directors’ and supervisors’ remuneration 52,824 211,203

$ 1,003,661 2,323,233