Asus 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

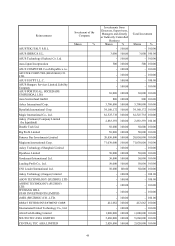

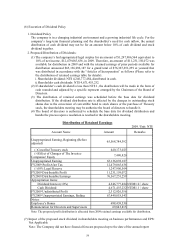

Shareholding

Shareholder’ s Name

Shareholding Shareholding Ratio (%)

Jonney Shih’ s trust account with the First Bank 60,000,000 1.41%

Rabobank’ s investment account of CitiBank

(Taiwan) 55,062,713 1.30%

Civil Servants Pension Fund Commission 51,575,426 1.21%

T.S. Tong’ s trust account with Chinatrust 50,000,000 1.18%

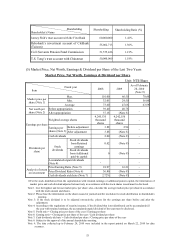

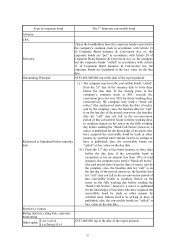

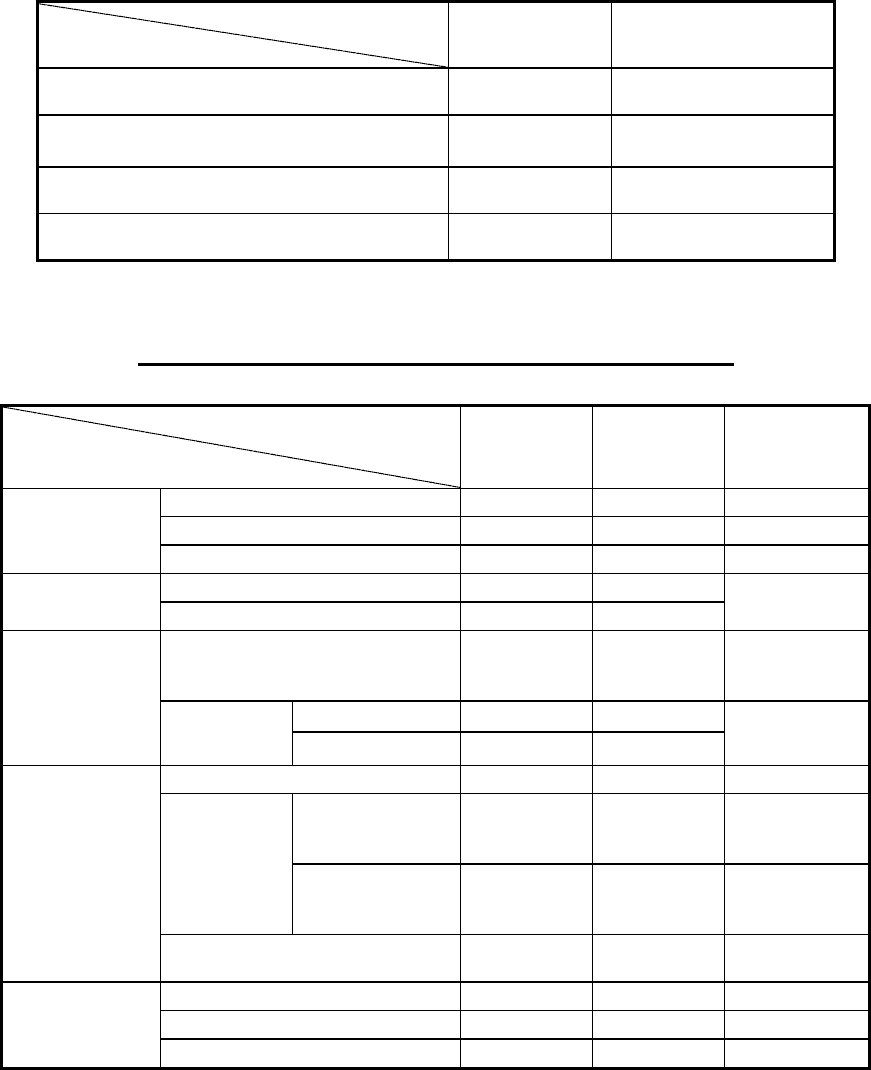

(5) Market Price, Net Worth, Earnings & Dividend per Share of the Last Two Years

Market Price, Net Worth, Earnings & Dividend per Share

Unit: NT$/Share

Fiscal year

Item 2008 2009

As of February

28, 2010

(Note 9)

Market price per

share (Note 1)

Max. 101.00 66.50 70.60

Min. 32.05 29.50 56.00

Average 73.60 47.66 63.59

Net worth per

share (Note 2)

Before appropriation 39.40 40.78 -

After appropriation 37.18 (Note 8)

Earnings per share

Weighted average shares

4,245,535

thousand

shares

4,242,156

thousand

shares

-

Earnings per

shares (Note 3)

Before adjustment 3.88 2.94 -

After adjustment 3.88 (Note 8)

Dividends per

share

Cash dividends 2.00 (Note 8) -

Stock

dividends

Stock dividends

from Retained

earnings

0.02 (Note 8) -

Stock dividends

from Additional

paid-in capital

0 (Note 8) -

Accumulated unpaid dividends

(Note 4) - - -

Analysis of return

on investment

Price/Earning Ratio (Note 5) 18.97 16.21 -

Price/Dividend Ratio (Note 6) 36.80 (Note 8) -

Cash dividends yield rate (Note 7) 2.72% (Note 8) -

*For the stock distribution from the capitalization with retained earnings or additional pain-in capital, the information of

market price and cash dividend adjusted retroactively in accordance with the stock shares issued must be disclosed.

Note 1: List the highest and lowest market price per share; also, calculate the average market price per share in accordance

with the trade amount and shares.

Note 2: Please base the information on the shares issued at yearned and the resolution for stock distribution in shareholders

meeting.

Note 3: If the stock dividend is to be adjusted retroactively, please list the earnings per share before and after the

adjustment.

Note 4: According to the regulations of security issuance, if the dividend that is not distributed can be accumulated till

the year with retained earnings, the accumulated unpaid dividend of the year must be disclosed.

Note 5: Profit ratio = Closing price per share of the year / Earning per share

Note 6: Earning ratio = Closing price per share of the year / Cash dividend per share

Note 7: Cash dividend yield rate = Cash dividend per share / Closing price per share of the year

Note 8: Subject to the approval of the annual shareholders meeting.

Note 9: The data collected up to February 28, 2010 were included in the report printed on March 22, 2010 for data

accuracy.