Aflac 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 Aflac Incorporated Annual Report for 2008

December 31, 2008, UPM was rated Baa3, BBB-, and BB+ by

Moody’s, S&P, and Fitch, respectively, and was classified by us

as an investment grade security. However, subsequent to year

end, UPM was downgraded to Ba1 by Moody‘s. As a result

of the downgrade by Moody‘s, we reclassified UPM to below

investment grade in the first quarter of 2009 in accordance

with our investment policy.

We have considered the factors impacting the fair value of

UPM as of December 31, 2008, and based on our credit

analysis, we believe that UPM’s ability to service its obligation

to Aflac is currently not impaired. Furthermore, the contractual

terms of this investment do not permit the issuer or its

parent to settle the security at a price less than the amortized

cost of the investment. Accordingly, we currently believe it

is probable that we will collect all amounts due according

to the contractual terms of the investment. Therefore, it is

expected that our investment would not be settled at a price

less than the amortized cost of the investment. Because we

have the intent and ability to hold this investment in UPM

until recovery of fair value, which may be the investments’

respective maturities, we do not consider these investments to

be other-than-temporarily impaired at December 31, 2008.

We have determined that the majority of the unrealized

losses on the investments in the other corporate sector were

caused by widening credit spreads globally and to a lesser

extent, changes in foreign exchange rates. Due to the liquidity

contraction experienced in the capital markets during 2008,

credit spreads continued to widen sharply throughout the year

causing the increase in the unrealized losses in this sector as of

December 31, 2008, compared with prior year. Also impacting

the unrealized losses in this sector is the decline in credit

worthiness of certain issuers in the other corporate sector.

However, consistent with our above discussions of certain

specific issuers within this sector, we have determined that the

ability of these issuers to service our investments has not been

impaired by these factors. Because we consider the decline

in the value of these securities to be temporary and because

we have the ability and intent to hold them until a recovery

of fair value, which may be maturity, we do not consider

these investments to be other than temporarily impaired at

December 31, 2008. Based on our credit related reviews of

the issuers in the other corporate sector, we have determined

that there is little risk that we will not recover our investment

in these issuers. Because we have the ability and intent to hold

these investments until a recovery of fair value, which may be

maturity, we do not consider these investments to be other-

than-temporarily impaired at December 31, 2008.

The majority of our investments in Upper Tier II and Tier

I perpetual securities were in highly-rated global financial

institutions. Upper Tier II securities have more debt-like

characteristics than Tier I securities and are senior to Tier

I securities, preferred stock, and common equity of the

issuer. Conversely, Tier I securities have more equity-like

characteristics, but are senior to the common equity of the

issuer. They may also be senior to preferred shares, depending

on the individual security, the issuer’s capital structure and the

regulatory jurisdiction of the issuer. Details of our holdings of

perpetual securities as of December 31, 2008, were as follows:

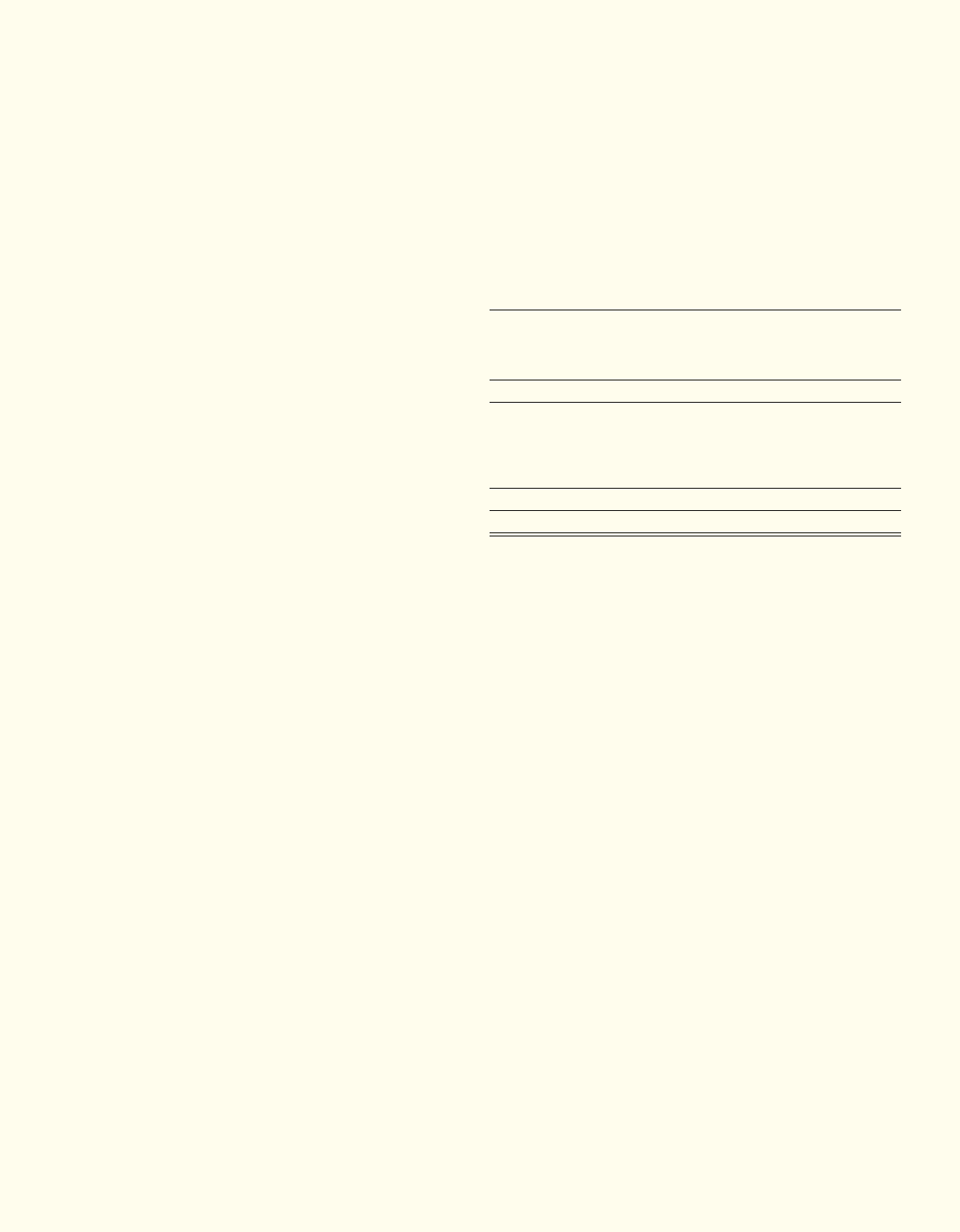

Perpetual Securities

Credit Amortized Fair Unrealized

(In millions) Rating Cost Value Gain (Loss)

Upper Tier II:

AA $ 3,534 $ 3,408 $ (126)

A 2,599 2,448 (151)

BBB 399 411 12

Total Upper Tier II 6,532 6,267 (265)

Tier I:

AA 937 683 (254)

A 1,302 891 (411)

BBB 170 118 (52)

BB 133 88 (45)

Total Tier I 2,542 1,780 (762)

Total $ 9,074 $ 8,047 $ (1,027)

At the end of 2008, 96% of the company’s total perpetual

securities in an unrealized loss position were investment

grade, compared with 93% at the end of the prior year. With

the exception of the previously mentioned Icelandic bank

securities that we impaired in the fourth quarter of 2008, all of

the perpetual securities we own were current on interest and

principal payments at the end of 2008. Based on amortized cost

as of December 31, 2008, the geographic breakdown by issuer

was as follows: Europe (65%); the United Kingdom (20%); and

Japan (12%). For any credit-related declines in market value,

we perform a more focused review of the related issuer’s credit

ratings, financial statements and other available financial data,

timeliness of payment, competitive environment and any other

significant data related to the issuer. From those reviews, we

evaluate the issuer’s continued ability to service our investment.

Included in the unrealized losses in the perpetual security

category was an unrealized loss of $106 million on Aflac

Japan’s investment of $393 million (¥35.7 billion) in perpetual

securities issued by Nordea Bank AB (Nordea) and its

subsidiaries. Included in our total investment in Nordea was

$283 million (¥25.7 billion) of instruments considered to be

Tier I instruments and $110 million (¥10 billion) in an Upper

Tier II instrument. The unrealized loss on Nordea increased

$82 million during the year ended December 31, 2008 as

compared with the prior year end.

Nordea is the largest financial services group in the Nordic

region with leading market positions in retail banking,