Aflac 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4Aflac Incorporated Annual Report for 2008

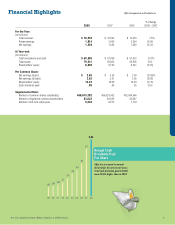

99 00 01 02 03 04 05 06 07 08

$16.6

8.6

9.7 9.6

10.3

11.4

13.3

14.4 14.6

15.4

Japan U.S.

Following a regulatory change, we began

offering our products to banking customers

over the counter in Japan at the start of

2008. We believe the opportunity to sell

through Japan’s vast banking network will

benefit our sales in the long run, as we have

established longstanding and extensive

relationships over the years within the

banking sector. In fact, we have secured a

much greater number of selling agreements

with banks than any of our competitors.

The second new channel was presented

when the Japan Post Network Co., Ltd.

selected Aflac to be the provider of cancer

insurance. The Japan Post Network Co.,

Ltd. has a long history of successfully selling

insurance to consumers. We began selling

through 300 post offices in October 2008.

These new opportunities add to our

confidence in Aflac Japan’s core competitive

strengths that have positioned us as the

number one seller of both cancer and

stand-alone medical insurance, and as

the largest insurer in Japan in terms of

individual policies in force. We also believe

the need for our products, combined with

our well-known and well-respected brand,

tremendous scale, efficient operations,

relevant products, broadening distribution

and dedicated customer service, will

continue to help Aflac stand out and

position us for future success.

Aflac U.S.

Throughout our history of operating for

more than 50 years in the United States,

we have never encountered a period when

the sale of our products was impacted by

economic conditions – until now. As each

quarter passed in 2008, it became clearer

that the purchase decisions of some of our

potential customers were being affected by

the weakening economy.

Although 2008 was a challenging year

for Aflac U.S. in terms of new annualized

premium sales, we concluded the year

convinced of one thing: The demand for

our products may have been temporarily

interrupted by the economic downturn, but

the need for the products we sell has not

changed. The incidence of serious illnesses like

cancer does not change with economic cycles,

nor do the costs associated with treatment

decline when times are tough. Actually, a case

can be made that Aflac’s protection products

are more needed in a weak economy because

of the increased likelihood a household has

for lower investment returns, fewer overtime

hours or even the loss of a steady income. We

believe now more than ever, consumers need

that extra layer of protection to provide peace

of mind in very uncertain times.

Aflac U.S. effectively recruited new sales

associates last year, and we also increased the

number of associates who regularly write

new business. In addition, we produced

solid growth in the opening of new payroll

accounts throughout the year. Our new sales

associates in particular were key drivers in

opening up new accounts and selling new

Total Revenues

(In billions)

Despite a significant increase

in realized investment losses,

total revenues rose 7.5%

to $16.6 billion in 2008,

benefiting from solid growth

in premium income and the

stronger yen.