Aflac 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Aflac Incorporated Annual Report for 2008

strengthened 25.4% relative to the U.S. dollar from the end of

2007 to the end of 2008.

We have investments in both publicly and privately issued

securities. The outstanding amount of a particular issuance,

as well as the level of activity in a particular issuance and

market conditions, including credit events and the interest

rate environment, affect liquidity regardless of whether it is

publicly or privately issued.

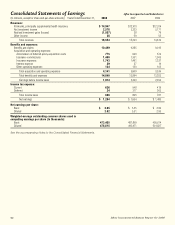

The following table details investment securities by type of

issuance as of December 31.

The following table details our privately issued investment

securities as of December 31.

Aflac Japan has invested in privately issued securities to secure

higher yields than those available on Japanese government

or other public corporate bonds. Aflac Japan’s investments in

yen-denominated privately issued securities consist primarily

of non-Japanese issuers and have longer maturities, thereby

allowing us to improve our asset/liability matching and our

overall investment returns. Most of our privately issued

securities are issued under medium-term note programs and

have standard documentation commensurate with credit

ratings, except when internal credit analysis indicates that

additional protective and/or event-risk covenants are required.

We use specific criteria to judge the credit quality of both

existing and prospective investments. Furthermore, we use

several methods to monitor these criteria, including credit

rating services and internal credit analysis. The distributions

by credit rating of our purchases of debt securities for the

years ended December 31, based on acquisition cost, were as

follows:

The percentage increase of debt securities purchased in the

BBB rated category during the year was due to the attractive

relative value these securities presented while still meeting our

investment policy guidelines for liquidity, safety and quality.

The increased percentage of debt securities purchased in the

AAA rated category in 2007 primarily reflects the purchase of

U.S. Treasury bills by Aflac Japan prior to repatriating profits

to Aflac U.S. in the third quarter of 2007. We did not purchase

any perpetual securities during the periods presented in the

table above.

The distributions of debt and perpetual securities we own, by

credit rating, as of December 31 were as follows:

Although our investment portfolio continues to be of high

credit quality, many downgrades occurred during 2008, causing

a shift in composition by credit rating. The percentage of AA

rated securities decreased primarily as a result of downgrades

of certain banks and financial institutions investments and

CDO investments. The percentage of A rated securities

increased principally due to purchases and downgrades of

Composition of Purchases by

Credit Rating

2008 2007 2006

AAA 9.9% 18.4% 10.6%

AA 36.4 44.1 48.9

A 42.0 30.2 35.1

BBB 11.7 7.3 5.4

Total 100.0% 100.0% 100.0%

Composition by Credit Rating

2008 2007

Amortized Fair Amortized Fair

Cost Value Cost Value

AAA 5.7% 5.8% 6.3% 6.2%

AA 39.8 42.2 44.3 45.3

A 34.1 33.2 30.7 30.4

BBB 18.6 17.6 16.8 16.6

BB or lower 1.8 1.2 1.9 1.5

Total 100.0% 100.0% 100.0% 100.0%

Privately Issued Securities

(Amortized cost, in millions) 2008

2007

Privately issued securities as a percentage of total

debt and perpetual securities 72.0% 70.3%

Privately issued securities held by Aflac Japan $ 47,516 $ 35,973

Privately issued securities held by Aflac Japan as

a percentage of total debt and perpetual securities 68.3% 66.0%

Privately issued reverse-dual currency securities* $ 14,678 $ 11,185

Reverse-dual currency securities* as a percentage of total

privately issued securities 29.3% 29.2%

* Principal payments in yen and interest payment in dollars

Investment Securities by Type of Issuance

2008 2007

Amortized Fair Amortized Fair

(In millions) Cost Value Cost Value

Publicly issued securities:

Fixed maturities $ 19,292 $ 19,525 $ 15,986 $ 16,919

Perpetual securities 156 104 173 157

Equity securities 15 18 13 19

Total publicly issued 19,463 19,647 16,172 17,095

Privately issued securities:

Fixed maturities 41,178 38,571 30,232 29,783

Perpetual securities 8,918 7,943 8,079 7,866

Equity securities 9 9 8 9

Total privately issued 50,105 46,523 38,319 37,658

Total investment securities $ 69,568 $ 66,170 $ 54,491 $ 54,753