Aflac 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 Aflac Incorporated Annual Report for 2008

securities are subordinated to other debt obligations of the

issuer, but rank higher than the issuers’ equity securities.

Perpetual securities have characteristics of both debt and

equity investments, along with unique features that create

economic maturity dates of the securities. Although these

securities have no contractual maturity date, they have

stated interest coupons that were fixed at their issuance and

subsequently change to a floating short-term rate of interest

of 125 to more than 300 basis points above an appropriate

market index, generally by the 25th year after issuance. We

believe this interest step-up penalty has the effect of creating

an economic maturity date of the perpetual securities. Since

first purchasing these securities in 1993, and until the third

quarter of 2008, we accounted for and reported perpetual

securities as debt securities and classified them as both

available-for-sale and held-to-maturity securities.

In light of the recent unprecedented volatility in the debt and

equity markets, we concluded in the third quarter of 2008

that all of our investments in perpetual securities should

be classified as available-for-sale securities. We have also

concluded that our perpetual securities should be evaluated

for other-than-temporary impairments using an equity security

impairment model as opposed to our previous policy of using

a debt security impairment model. We recognized realized

investment losses of $294 million ($191 million after-tax) in

2008 as a result of applying our equity impairment model

to this class of securities through June 30, 2008. Included in

the $191 million other-than-temporary impairment charge is

$40 million, $53 million, $50 million, and $38 million, net of

tax, that relate to the years ended December 31, 2007, 2006,

2005 and 2004, respectively; and, $10 million, net of tax,

that relates to the quarter ended June 30, 2008. There were

no impairment charges related to the perpetual securities

in the first quarter of 2008. The impact of classifying all

of our perpetual securities as available-for-sale securities

and assessing them for other-than-temporary impairments

under our equity impairment model was determined to be

immaterial to our results of operations and financial position

for any previously reported period. In response to the SEC

letter mentioned above regarding the appropriate impairment

model for hybrid securities, we applied our debt security

impairment model to our perpetual securities in the third and

fourth quarters of 2008 and will continue with that approach

pending further guidance from the SEC or the FASB.

In September 2006, the Securities and Exchange Commission

(SEC) issued Staff Accounting Bulletin No. 108 (SAB 108).

SAB 108 addresses quantifying the financial statement effects

of misstatements, specifically, how the effects of uncorrected

errors from prior years must be considered in quantifying

misstatements in current year financial statements. Under

the provisions of SAB 108, a reporting entity must quantify

and evaluate errors using a balance sheet approach and an

income statement approach. After considering all relevant

quantitative and qualitative factors, if either approach

results in a misstatement that is material, a reporting entity’s

financial statements must be adjusted. SAB 108 applies to

SEC registrants and is effective for fiscal years ending after

November 15, 2006. In the course of evaluating balance sheet

amounts in accordance with the provisions of SAB 108, we

identified the following amounts that we adjusted for as of

January 1, 2006: a tax liability in the amount of $87 million

related to deferred tax asset valuation allowances that were

not utilized; a tax liability in the amount of $45 million related

to various provisions for taxes that were not utilized; and

a litigation liability in the amount of $11 million related to

provisions for various pending lawsuits that were not utilized.

These liabilities were recorded in immaterial amounts prior

to 2004 over a period ranging from 10 to 15 years. However,

using the dual evaluation approach prescribed by SAB 108,

correction of the above amounts would be material to 2006

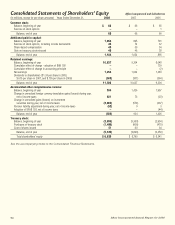

earnings. In accordance with the provisions of SAB 108, the

following amounts, net of tax where applicable, have been

reflected as an opening adjustment to retained earnings as of

January 1, 2006: a reduction of tax liabilities in the amount of

$132 million; a reduction of litigation reserves in the amount

of $11 million; and a reduction in deferred tax assets in the

amount of $4 million. These three adjustments resulted in

a net addition to retained earnings in the amount of $139

million.

Recent accounting guidance not discussed above is not

applicable to our business.

2. BUSINESS SEGMENT AND FOREIGN

INFORMATION

The Company consists of two reportable insurance business

segments: Aflac Japan and Aflac U.S., both of which sell

individual supplemental health and life insurance.

Operating business segments that are not individually

reportable are included in the “Other business segments”

category. We do not allocate corporate overhead expenses

to business segments. We evaluate and manage our business

segments using a financial performance measure called pretax

operating earnings. Our definition of operating earnings

excludes the following items from net earnings on an after-tax

basis: realized investment gains/losses, the impact from SFAS

133, and nonrecurring items. We then exclude income taxes

related to operations to arrive at pretax operating earnings.

Information regarding operations by segment for the years

ended December 31 follows: