Aflac 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

It’s no mystery how Aflac makes a difference.

Policyholder Protection Corporation and State Guaranty

Association Assessments: In Japan, the government

has required the insurance industry to contribute to a

policyholder protection corporation. We recognize a charge

for our estimated share of the industry’s obligation once

it is determinable. We review the estimated liability for

policyholder protection corporation contributions on an

annual basis and report any adjustments in Aflac Japan’s

expenses.

In the United States, each state has a guaranty association that

supports insolvent insurers operating in those states. To date,

our state guaranty association assessments have not been

material.

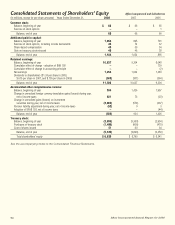

Treasury Stock: Treasury stock is reflected as a reduction of

shareholders’ equity at cost. We use the weighted-average

purchase cost to determine the cost of treasury stock that is

reissued. We include any gains and losses in additional paid-in

capital when treasury stock is reissued.

Earnings Per Share: We compute basic earnings per share

(EPS) by dividing net earnings by the weighted-average

number of unrestricted shares outstanding for the period.

Diluted EPS is computed by dividing net earnings by the

weighted-average number of shares outstanding for the

period plus the shares representing the dilutive effect of

share-based awards.

New Accounting Pronouncements: In January 2009,

the FASB issued FASB Staff Position (FSP) EITF 99-20-1,

“Amendments to the Impairment Guidance of EITF Issue

No. 99-20.” This FSP affects all entities with certain

beneficial interests in securitized financial assets within the

scope of EITF Issue No. 99-20. In determining other-than-

temporary-impairment, Issue 99-20 requires reliance on

market participant assumptions about future cash flows.

While Statement of Financial Accounting Standards (SFAS)

No. 115, “Accounting for Certain Investments in Debt and

Equity Securities” (SFAS 115) uses these same assumptions,

it permits the use of reasonable management judgment

on the probability that the holder will be unable to collect

all amounts due. This FSP brings the impairment model on

beneficial interest held by a transferor in securitized financial

assets, to be similar to the impairment model of SFAS 115.

The FSP is effective for interim and annual reporting periods

ending after December 15, 2008. The adoption of this

standard did not have a material impact on our financial

position or results of operations.

In December 2008, the FASB issued FSP FAS 140-4 and FIN

46(R)-8, “Disclosures by Public Entities (Enterprises) about

Transfers of Financial Assets and Interests in Variable Interest

Entities” (FSP FAS 140-4 and FIN 46(R)-8). This disclosure-

only FSP improves the transparency of transfers of financial

assets and an enterprise’s involvement with variable interest

entities (VIEs), including qualifying special-purpose entities

(QSPEs). The additional required disclosures related to

asset transfers primarily focus on the transferor’s continuing

involvement with transferred financial assets and the related

risks retained. This FSP also requires additional disclosures that

focus on a company’s involvement with VIEs and its judgments

about the accounting for them. In addition, the FSP requires

certain nontransferor public enterprises to disclose details

about QSPEs with which they are involved. We adopted the

provisions of FSP FAS 140-4 and FIN 46(R)-8 as of December

31, 2008. The adoption of this standard did not have an

impact on our financial position or results of operations.

In December 2008, the FASB issued FSP FAS 132(R)-1,

“Employer’s Disclosures about Postretirement Benefit Plan

Assets.” This FSP amends SFAS No. 132(R), “Employers’

Disclosures about Pensions and Other Postretirement

Benefits — An Amendment of FASB Statements No. 87, 88,

and 106” to require more detailed disclosures about plan

assets of a defined benefit pension or other postretirement

plan, including investment strategies; major categories of

plan assets; concentrations of risk within plan assets; inputs

and valuation techniques used to measure the fair value of

plan assets; and the effect of fair-value measurements using

significant unobservable inputs on changes in plan assets for

the period. FSP 132(R)-1 is effective for fiscal years ending

after December 15, 2009, with earlier application permitted.

We do not expect the adoption of this standard to have an

effect on our financial position or results of operations.

In October 2008, the FASB issued FSP No. FAS 157-3,

“Determining the Fair Value of a Financial Asset When the

Market for That Asset Is Not Active” (FSP FAS 157-3). This FSP

provides additional guidance regarding the application of SFAS

No. 157, “Fair Value Measurements,” in an inactive market

and illustrates how an entity would determine fair value when

the market for a financial asset is not active. FSP FAS 157-3

is effective immediately upon issuance and applies to prior

periods for which financial statements have not been issued.

We adopted the provisions of FSP FAS 157-3 as of September

30, 2008. The adoption of this standard did not have an

impact on our financial position or results of operations.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy

of Generally Accepted Accounting Principles” (SFAS 162).

This standard identifies the sources of accounting principles

and the framework for selecting the principles to be used in

the preparation of financial statements of nongovernmental

entities that are presented in conformity with GAAP. SFAS 162