Aflac 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

It’s no mystery how Aflac makes a difference.

Our investment discipline begins with a top-down approach

for each investment opportunity we consider. Consistent

with that approach, we first approve each country in which

we invest. In our approach to sovereign analysis, we consider

the political, legal and financial context of the sovereign

entity in which an issuer is domiciled and operates. Next we

approve the issuer’s industry sector, including such factors as

the stability of results and the importance of the sector to

the overall economy. Specific credit names within approved

countries and industry sectors are evaluated for their market

position and specific strengths and potential weaknesses.

Structures in which we invest are chosen for specific portfolio

management purposes, including asset/liability management,

portfolio diversification and net investment income.

Our largest investment industry sector concentration is banks

and financial institutions. Within the countries we approve

for investment opportunities, we primarily invest in financial

institutions that are strategically crucial to each approved

country’s economy. The banks and financial institutions sector

is a highly regulated industry and plays a strategic role in the

global economy. We achieve some degree of diversification

in the banks and financial institutions sector through a

geographically diverse universe of credit exposures. Within this

sector, the more significant concentration of our credit risk by

geographic region or country of issuer at December 31, 2008,

based on amortized cost, was: Europe (48%); United States

(20%); United Kingdom (9%); and Japan (9%).

Our total investments in the banks and financial institutions

sector, including those classified as perpetual securities, as of

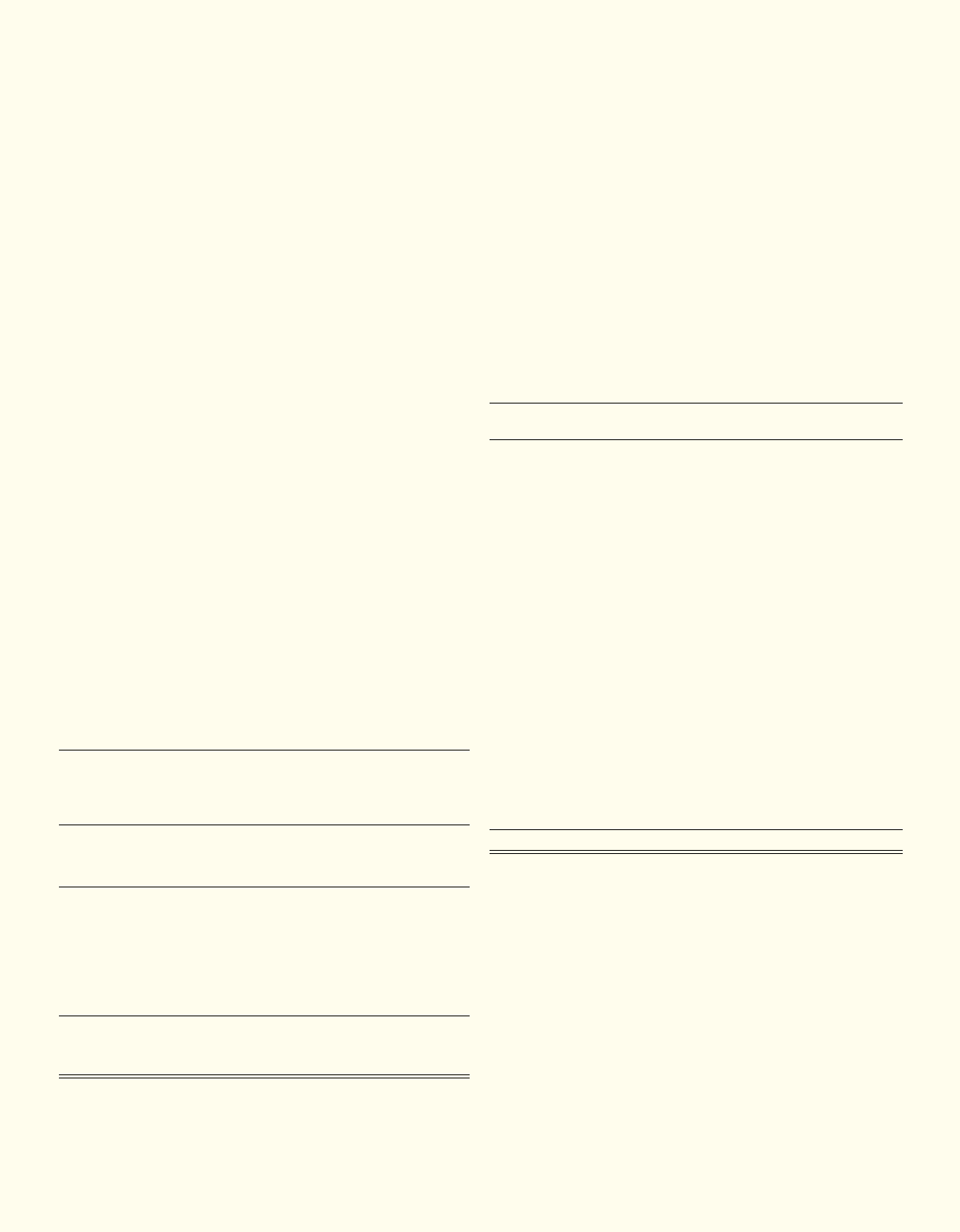

December 31 were as follows:

At December 31, 2008, we owned below-investment-grade

debt and perpetual securities in the amount of $1.3 billion at

amortized cost ($786 million at fair value), or 1.8% of total

debt and perpetual securities, compared with $1.0 billion at

amortized cost ($815 million at fair value), or 1.9% of total

debt and perpetual securities a year ago. Each of the

below-investment-grade securities was investment grade

at the time of purchase and was subsequently downgraded

by credit rating agencies. These securities are held in the

available-for-sale portfolio.

Debt and perpetual securities classified as below investment

grade as of December 31 were as follows:

Information regarding realized and unrealized gains and losses

from investments for the years ended December 31 appears in

the table at the top of the following page:

2008 2007

Total Investments in Total Investments in

Banks and Financial Percentage of Banks and Financial Percentage of

Institutions Sector Total Investment Institutions Sector Total Investment

(in millions) Portfolio (in millions) Portfolio

Debt securities:

Amortized cost $ 19,868 28% $ 15,948 29%

Fair value 17,793 27 15,563 28

Perpetual securities:

Upper Tier II:

Amortized cost $ 6,238 9% $ 5,549 10%

Fair value 5,960 9 5,732 11

Tier I:

Amortized cost 2,542 4 2,439 5

Fair value 1,780 3 2,047 4

Total:

Amortized cost $ 28,648 41% $ 23,936 44%

Fair value 25,533 39 23,342 43

Below-Investment-Grade Securities

2008 2007

Par Amortized Fair Par Amortized Fair

(In millions) Value Cost Value Value Cost Value

Ford Motor Credit $ 329 $ 329 $ 143 $ 263 $ 263 $ 215

Ahold * * * 310 311 272

CSAV 264 264 157 210 210 143

BAWAG*** 154 133 88 123 123 90

IKB Deutsche Industriebank 143 143 47 * * *

Beryl Finance Limited 2008-7**** 110 110 116 * * *

Ford Motor Company 111 57 31 111 122 93

Glitnir Bank HF 95(1) – – * * *

Beryl Finance Limited 2007-14**** 82 53 53 * * *

Beryl Finance Limited 2006-15**** 55 43 43 * * *

Beryl Finance Limited 2007-5**** 55 44 44 * * *

Morgan Stanley Aces 2007-21**** 55 3 3 * * *

Landsbanki Islands HF 55 – – * * *

Rinker Materials Corp. 43 42 23 * * *

Morgan Stanley Aces 2007-19**** 30 4 4 * * *

Kaupthing Bank*** 30 – – * * *

Sprint Capital 22 24 16 * * *

Academica Charter Schools Finance LLC 22 24 17 * * *

International Securities Trading Corp. 18 – – 20 – –

Tiers Georgia**** 11 1 1 * * *

Patrick Family Housing (Patrick AFB) ** ** ** 4 1 1

Aloha Utilities Inc. ** ** ** 2 2 1

Total $ 1,684 $ 1,274 $ 786 $ 1,043 $ 1,032 $ 815

* Investment grade at respective reporting date

** Sold during 2008

*** Perpetual security

**** CDO security

(1) Includes $55 million for a perpetual security