Aflac 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

It’s no mystery how Aflac makes a difference.

factor method because the actual cash payments to date for

claims 13 or more months old are deemed to have sufficient

credibility on which to base the remaining liability estimate.

Prior to the 13th month, the historical claim cost method is

deemed to have more credibility. The difference in estimate

between the two methods is routinely recognized in our

financial statements in the 13th month after a claim is incurred.

For the past several years, we have experienced a downward

trend in our current period hospitalization claim costs,

primarily in Japan. For this reason, our claim cost estimate as

of December 31, 2006, was high. Redundancy or insufficiency

is initially recognized when the claims reach the thirteenth

month after incurral. More than 75% of the 2007 release of

prior period claim liability was related to claims incurred in

2006. The remainder was related to claims incurred prior to

2006.

In computing the estimate of unpaid policy claims, we

consider many factors, including the benefits and amounts

available under the policy; the volume and demographics

of the policies exposed to claims; and internal business

practices, such as incurred date assignment and current claim

administrative practices. We monitor these conditions closely

and make adjustments to the liability as actual experience

emerges. Claim levels are generally stable from period to

period; however, fluctuations in claim levels may occur. In

calculating the unpaid policy claim liability, we do not calculate

a range of estimates. The following table shows the expected

sensitivity of the unpaid policy claims liability as of December

31, 2008, to changes in severity and frequency of claims. For

the years 2006 through 2008, our assumptions changed on

average by approximately 1% in total, and we believe that a

variation in assumptions in a range of plus or minus 1% in

total is reasonably likely to occur.

The following table reflects the growth of future policy

benefits liability for the years ended December 31.

The growth of the future policy benefits liability in dollars is

primarily due to the aging of our in-force block of business

and the addition of new business, as well as the strengthening

of the yen against the U.S. dollar.

New Accounting Pronouncements

During the last three years, various accounting standard-setting

bodies have been active in soliciting comments and issuing

statements, interpretations and exposure drafts. For information

on new accounting pronouncements and the impact, if any, on

our financial position or results of operations, see Note 1 of the

Notes to the Consolidated Financial Statements.

RESULTS OF OPERATIONS

The following table is a presentation of items impacting net

earnings and net earnings per diluted share for the years

ended December 31.

Realized Investment Gains and Losses

Our investment strategy is to invest in investment-grade fixed-

income securities to provide a reliable stream of investment

income, which is one of the drivers of the Company’s

profitability. This investment strategy aligns our assets with

our liability structure, which our assets support. We do not

purchase securities with the intent of generating capital

gains or losses. However, investment gains and losses may be

realized as a result of changes in the financial markets and the

creditworthiness of specific issuers, tax planning strategies,

and/or general portfolio maintenance and rebalancing. The

realization of investment gains and losses is independent

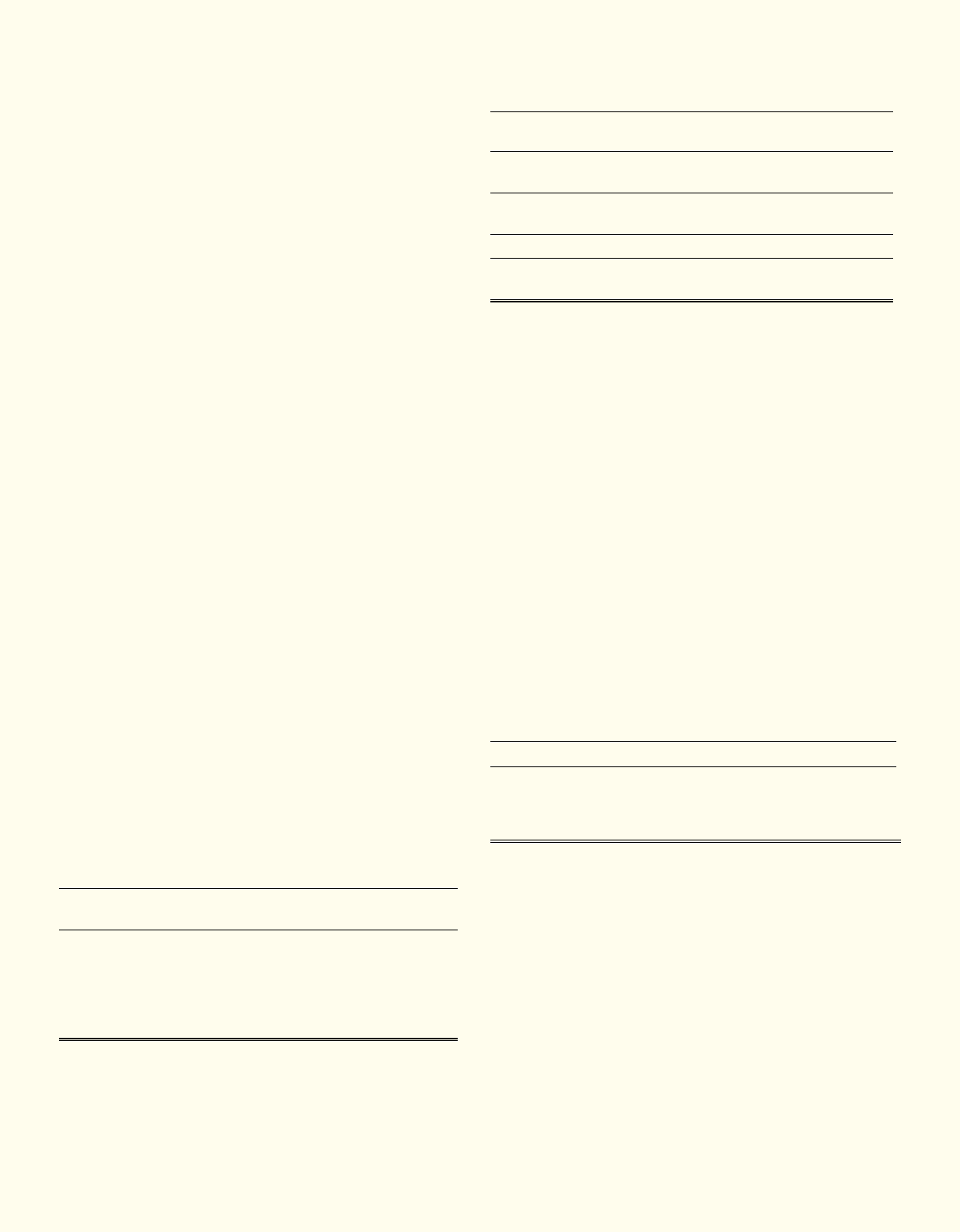

Sensitivity of Unpaid Policy

Claims Liability

Total Severity

Decrease Decrease Increase Increase

(In millions) by 2% by 1% Unchanged by 1% by 2%

Total Frequency

Increase by 2% $ – $ 19 $ 39 $ 59 $ 79

Increase by 1% (19) – 20 39 59

Unchanged (38) (19) – 20 39

Decrease by 1% (57) (38) (19) – 19

Decrease by 2% (76) (57) (38) (19) –

Future Policy Benefits

(In millions of dollars and billions of yen) 2008 2007

2006

Aflac U.S. $ 5,442 $ 4,958 $ 4,391

Growth rate 9.8% 12.9% 16.2%

Aflac Japan $ 53,866 $ 40,715 $ 36,447

Growth rate 32.3% 11.7% 7.0%

Consolidated $ 59,310 $ 45,675 $ 40,841

Growth rate 29.9% 11.8% 7.9%

Yen/dollar exchange rate (end of period) 91.03 114.15 119.11

Aflac Japan ¥ 4,903 ¥ 4,648 ¥ 4,341

Growth rate 5.5% 7.1% 7.9%

Items Impacting Net Earnings

In Millions Per Diluted Share

2008 2007 2006 2008 2007 2006

Net earnings $1,254 $1,634 $1,483 $2.62 $3.31 $2.95

Items impacting net earnings, net of tax:

Realized investment gains (losses) (655) 19 51 (1.37) .04 .10

Impact from SFAS 133 (3) 2 – – – –