Aflac 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 Aflac Incorporated Annual Report for 2008

is effective as of November 15, 2008. The adoption of this

standard did not have an effect on our financial position or

results of operations.

In March 2008, the FASB issued SFAS No. 161, “Disclosures

about Derivative Instruments and Hedging Activities — an

amendment of FASB Statement No. 133” (SFAS 161). FASB

Statement No. 133, Accounting for Derivative Instruments

and Hedging Activities , establishes, among other things, the

disclosure requirements for derivative instruments and for

hedging activities. This statement amends and expands the

disclosure requirements of Statement 133 with the intent

to provide users of financial statements with an enhanced

understanding of how and why an entity uses derivative

instruments, how derivative instruments and related hedged

items are accounted for under Statement 133 and its related

interpretations, and how derivative instruments and related

hedged items affect an entity’s financial position, financial

performance, and cash flows. To meet those objectives, this

statement requires qualitative disclosures about objectives

and strategies for using derivatives, quantitative disclosures

about fair value amounts of and gains and losses on derivative

instruments, and disclosures about credit-risk-related

contingent features in derivative agreements. SFAS 161 is

effective for financial statements issued for fiscal years and

interim periods beginning after November 15, 2008. We do

not expect the adoption of this standard to have an effect on

our financial position or results of operations.

In December 2007, the FASB issued SFAS No. 160,

“Noncontrolling Interests in Consolidated Financial Statements

— an amendment of ARB No. 51” (SFAS 160). The purpose

of SFAS 160 is to improve relevance, comparability, and

transparency of the financial information that a reporting entity

provides in its consolidated financial statements by establishing

accounting and reporting standards for the noncontrolling

interest in a subsidiary and for the deconsolidation of a

subsidiary. SFAS 160 is effective for fiscal years beginning on or

after December 15, 2008, with earlier adoption prohibited. We

do not expect the adoption of this standard to have an effect

on our financial position or results of operations.

In February 2007, the FASB issued SFAS No. 159, “The Fair

Value Option for Financial Assets and Financial Liabilities —

including an amendment of FASB Statement No. 115” (SFAS

159). SFAS 159 allows entities to choose to measure many

financial instruments and certain other items at fair value.

The majority of the provisions of this standard apply only to

entities that elect the fair value option (FVO). The FVO may

be applied to eligible items on an instrument-by-instrument

basis; is irrevocable unless a new election date occurs; and

may only be applied to an entire financial instrument, and not

portions thereof. This standard requires a business enterprise

to report unrealized gains and losses on items for which

the FVO has been elected in earnings at each subsequent

reporting date. SFAS 159 is effective for fiscal years beginning

after November 15, 2007, with earlier application permitted

under limited circumstances. In connection with our adoption

of SFAS 159 as of January 1, 2008, we did not elect the FVO

for any of our financial assets and liabilities. Accordingly, the

adoption of this standard did not have an impact on our

financial position or results of operations.

In September 2006, the FASB issued SFAS No. 158,

“Employers’ Accounting for Defined Benefit Pension

and Other Postretirement Plans, an amendment of FASB

Statements No. 87, 88, 106, and 132(R)” (SFAS 158).

We adopted the recognition and measurement date

provisions of this standard effective December 31, 2006.

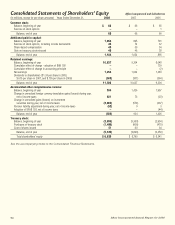

In the consolidated statements of shareholders’ equity

for the year ended December 31, 2006, we included in

2006 other comprehensive income a cumulative transition

adjustment, net of income taxes, of $44 million from the

adoption of SFAS 158. This cumulative effect adjustment

was properly included in the rollforward of accumulated

other comprehensive income for the year, but it should not

have been included in other comprehensive income for the

year. Total comprehensive income for the year, not including

the transition adjustment for SFAS 158, was $996 million.

Management concluded that the transition adjustment was

not material to the financial statements taken as a whole.

We have adjusted other comprehensive income for the

year ended December 31, 2006, to properly reflect the

transition adjustment as a direct charge to accumulated other

comprehensive income. The effect of recording the transition

adjustment through other comprehensive income and the

subsequent adjustment to reflect the amounts as a direct

charge to accumulated other comprehensive income did not

have any impact on the consolidated statements of earnings,

the consolidated balance sheets, the consolidated statements

of shareholders’ equity or the consolidated statements of cash

flows for any periods presented.

In September 2006, the FASB issued SFAS No. 157, “Fair

Value Measurements” (SFAS 157). SFAS 157 defines fair

value, establishes a framework for measuring fair value under

GAAP, expands disclosures about fair value measurements

and specifies a hierarchy of valuation techniques based

on whether the inputs to those valuation techniques are

observable or unobservable. Observable inputs reflect market

data corroborated by independent sources while unobservable

inputs reflect market assumptions that are not observable

in an active market or are developed internally. These two

types of inputs create three valuation hierarchy levels. Level 1