Aflac 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 Aflac Incorporated Annual Report for 2008

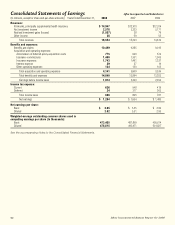

Gross realized pretax investment losses on debt and perpetual

securities, as a result of sales and impairment charges, were as

follows for the year ended December 31, 2008:

See Notes 1 and 3 of the Notes to the Consolidated Financial

Statements and the Realized Investment Gains and Losses

section of this MD&A for additional information.

Investment Valuation and Cash

SFAS 157 specifies a hierarchy of valuation techniques based

on whether the inputs to those valuation techniques are

observable or unobservable. These two types of inputs create

three valuation hierarchy levels. Level 1 valuations reflect

quoted market prices for identical assets or liabilities in active

markets. Level 2 valuations reflect quoted market prices for

similar assets or liabilities in an active market, quoted market

prices for identical or similar assets or liabilities in non-active

markets or model derived valuations in which all significant

valuation inputs are observable in active markets. Level 3

valuations reflect valuations in which one or more of the

significant valuation inputs are not observable in an active

market. The vast majority of our financial instruments subject

to the classification provisions of SFAS 157 relate to our

investment securities classified as securities available for sale in

our investment portfolio. We determine the fair value of our

securities available for sale using several sources or techniques

based on the type and nature of the investment securities.

For securities categorized as Level 1, we obtain quoted market

prices for identical securities traded in active markets that are

readily and regularly available to us.

For securities categorized as Level 2, we determine the fair

value using three techniques, depending on the source and

availability of market inputs. Of these securities, approximately

36% are valued by obtaining quoted prices from our custodian.

The custodian obtains price quotes from various pricing

services who estimate their fair values based on observable

market transactions for similar investments in active markets,

market transactions for the same investments in inactive

markets or other observable market data where available.

The fair value of approximately 59% of our Level 2 securities is

determined using discounted cash flow (DCF) pricing models

that employ observable and corroborated market inputs from

both active and inactive markets. The estimated fair values

developed by the DCF pricing models are most sensitive to

prevailing credit spreads, the level of interest rates (yields)

and interest rate volatility. Credit spreads are derived based

on pricing data obtained from investment brokers and take

into account the current yield curve, time to maturity and

subordination levels for similar securities or classes of securities.

We validate the reliability of the DCF pricing models periodically

by using the models to price investments for which there are

quoted market prices from active markets or, in the alternative,

are quoted by our custodian. For the remaining Level 2

securities that are not quoted by our custodian and cannot be

priced under the DCF pricing model, we obtain specific broker

quotes from up to three brokers and use the average of the

three quotes to estimate the fair value of the securities.

The fair value of our securities classified as Level 3 is estimated

by obtaining broker quotes from a limited number of brokers.

These brokers base their quotes on a combination of their

knowledge of the current pricing environment and market

flows. We consider these inputs unobservable.

As a result of the continued contraction of observable

valuation inputs, we transferred investments totaling $2.7

billion into Level 3 during the fourth quarter of 2008.

Included in these transfers were our below-investment-grade

investments, callable reverse-dual currency (RDC) investments

and certain of our private placement securities. Transfers into

Level 3 prior to the fourth quarter totaled $245 million and

consisted of various other hard-to-value investment securities.

The significant valuation inputs that are used in the valuation

process for the below-investment-grade, callable RDC and

private placement investments classified as Level 3 include

forward exchange rates, yen swap rates, dollar swap rates,

interest rate volatilities, credit spread data on specific issuers,

assumed default and default recovery rates, certain probability

assumptions, and call option data.

Some of these securities require the calculation of a

theoretical forward exchange rate which is developed by using

yen swap rates, U.S. dollar swap rates, interest rate volatilities,

and spot exchange rates. The forward exchange rate is then

Gross Realized Losses on

Debt and Perpetual Securities

Sales Total Realized

(In millions)

Proceeds Losses Impairments Losses

Investment-grade securities,

length of consecutive unrealized loss:

Less than six months $ 258 $ 50 $ – $ 50

Six months to 12 months 67 38 15 53

Over 12 months 79 186 358 544

Below-investment-grade securities,

length of consecutive unrealized loss:

Less than six months 90 1 29 30

Six months to 12 months – – 40 40

Over 12 months 1 – 310 310

Total $ 495 $ 275 $ 752 $ 1,027

(In millions) 2008 2007 2006

Debt securities $ 373 $ 22 $ –

Perpetual securities 379 – –

Equity securities 1 1 1

Total $ 753 $ 23 $ 1