Aflac 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Aflac Incorporated Annual Report for 2008

1. SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Description of Business: Aflac Incorporated (the Parent

Company) and its subsidiaries (the Company) primarily sell

supplemental health and life insurance in the United States

and Japan. The Company’s insurance business is marketed

and administered through American Family Life Assurance

Company of Columbus (Aflac), which operates in the United

States (Aflac U.S.) and as a branch in Japan (Aflac Japan).

Most of Aflac’s policies are individually underwritten and

marketed through independent agents. Our insurance

operations in the United States and our branch in Japan

service the two markets for our insurance business. Aflac

Japan accounted for 72% of the Company’s total revenues in

2008, 71% in 2007 and 72% in 2006, and 87% and 82% of

total assets at December 31, 2008 and 2007, respectively.

Basis of Presentation: We prepare our financial statements in

accordance with U.S. generally accepted accounting principles

(GAAP). These principles are established primarily by the

Financial Accounting Standards Board (FASB). The preparation

of financial statements in conformity with GAAP requires us

to make estimates when recording transactions resulting from

business operations based on currently available information.

The most significant items on our balance sheet that involve

a greater degree of accounting estimates and actuarial

determinations subject to changes in the future are the

valuation of investments, deferred policy acquisition costs, and

liabilities for future policy benefits and unpaid policy claims.

These accounting estimates and actuarial determinations are

sensitive to market conditions, investment yields, mortality,

morbidity, commission and other acquisition expenses, and

terminations by policyholders. As additional information

becomes available, or actual amounts are determinable, the

recorded estimates will be revised and reflected in operating

results. Although some variability is inherent in these

estimates, we believe the amounts provided are adequate.

The consolidated financial statements include the accounts

of the Parent Company, its majority-owned subsidiaries and

those entities required to be consolidated under applicable

accounting standards. All material intercompany accounts and

transactions have been eliminated.

Translation of Foreign Currencies: The functional currency

of Aflac Japan’s insurance operations is the Japanese yen. We

translate our yen-denominated financial statement accounts

into U.S. dollars as follows. Assets and liabilities are translated

at end-of-period exchange rates. Realized gains and losses on

security transactions are translated at the exchange rate on

the trade date of each transaction. Other revenues, expenses

and cash flows are translated using average exchange rates for

the year. The resulting currency translation adjustments are

reported in accumulated other comprehensive income. We

include in earnings the realized currency exchange gains and

Notes to the Consolidated Financial Statements

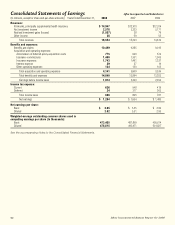

Consolidated Statements of Comprehensive Income Aflac Incorporated and Subsidiaries

(In millions) Years Ended December 31, 2008 2007 2006

Net earnings $ 1,254 $ 1,634 $ 1,483

Other comprehensive income (loss) before income taxes:

Foreign currency translation adjustments:

Change in unrealized foreign currency translation gains (losses) during year 164 (8) (12)

Unrealized gains (losses) on investment securities:

Unrealized holding gains (losses) during year (4,078) (848) (642)

Reclassification adjustment for realized (gains) losses included in net earnings 926 (28) (79)

Unrealized gains (losses) on derivatives:

Unrealized holding gains (losses) during year (2) (1) –

Pension liability adjustment during year (81) 14 5

Total other comprehensive income (loss) before income taxes (3,071) (871) (728)

Income tax expense (benefit) related to items of other

comprehensive income (loss) (1,555) (379) (241)

Other comprehensive income (loss), net of income taxes (1,516) (492) (487)

Total comprehensive income (loss) $ (262) $ 1,142 $ 996

See the accompanying Notes to the Consolidated Financial Statements.