Aflac 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

It’s no mystery how Aflac makes a difference.

bridge policy in 2008 that allows existing

policyholders to upgrade their coverage to

that of Cancer Forte.

Given the challenges facing Japan’s national

health care system, we also believe the

fundamental need for supplemental medical

products remains strong. Since first launching

a stand-alone medical product called EVER in

2002, we have been the number one seller

of medical insurance policies in Japan. In the

last five years, we have segmented the market

by developing variations of EVER that appeal

to specific types of Japanese consumers,

including our most recent medical product

Gentle EVER, which we introduced in August

2007. Gentle EVER provides an affordable

alternative to help consumers who may have

a health condition that would exclude them

from purchasing other EVER products.

In November 2008, we introduced a new

product to the market called Sanjuso. This

innovative new offering is a single-premium

product that provides lump-sum payments

upon the diagnosis of cancer, heart attack

or stroke, as well as a death benefit. It was

primarily designed for the bank channel. Initial

sales of Sanjuso were undoubtedly impacted

by the financial crisis. However, we believe it

will fit well in bank agents’ product portfolios,

particularly those of the mega banks and larger

regional banks in Japan.

New Distribution Opportunities

Broaden Sales Platform

In terms of distribution, 2008 presented new

avenues for selling our products. Japan’s

Financial Services Agency (FSA) approved

the over-the-counter sale of additional

insurance products, including the kind sold

by Aflac. Although we have been selling to

employees of Japan’s banks since we first

entered the market more than 30 years ago,

2008 was the first time we were permitted

to sell over the counter to customers

of banks. We believe our long-standing

and far-reaching relationships within the

banking sector have given us an advantage

in developing this channel and have been

Policies Annualized Total New Total

and Riders Premiums Annualized Number of

In Force* In Force** Premiums** Agencies

2008 29,020 ¥1,161,662 ¥114,692 18,882

2007 28,443 1,125,561 114,636 18,461

2006 27,334 1,083,127 117,455 18,432

2005 26,014 1,027,762 128,784 17,960

2004 24,477 961,895 122,525 16,410

2003 23,097 900,251 121,170 14,643

2002 21,867 834,424 108,320 12,056

2001 20,802 782,249 91,865 9,839

2000 19,674 740,445 99,755 8,938

1999 18,510 696,622 87,043 8,283

*In thousands **In millions

Aflac Japan

Sales Results

Aflac Japan did not achieve its

sales objective, although total

new annualized premium sales

were up slightly for the year.

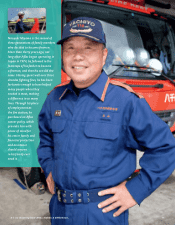

“ How lucky we were to have Aflac cancer insurance! That is really all I can say.

It is because of Aflac that my husband was able to stay in a private room and

get more than adequate treatment and care. We are very thankful.”

—Claimant’s spouse; Kansai area, Japan