Aflac 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

It’s no mystery how Aflac makes a difference.

assumptions for future policy persistency, mortality and

morbidity. The distribution of payments for unpaid policy

claims includes assumptions as to the timing of policyholders

reporting claims for prior periods and the amount of those

claims. Actual amounts and timing of both future policy

benefits and unpaid policy claims payments may differ

significantly from the estimates above. We anticipate that

the future policy benefit liability of $59.3 billion at December

31, 2008, along with future net premiums and investment

income, will be sufficient to fund future policy benefit

payments.

The distribution of payments due in less than one year for

long-term debt consists of $450 million for our senior notes

that are due in April 2009. We plan to either refinance,

subject to market conditions, or use existing cash to pay off

the aforementioned senior notes. The cross-currency interest-

rate swaps related to our senior notes will expire in April 2009

and as of December 31, 2008, would have required a payment

of $155 million to the swap counterparties. See Notes 4 and

7 of the Notes to the Consolidated Financial Statements for

more information.

Consolidated Cash Flows

We translate cash flows for Aflac Japan’s yen-denominated

items into U.S. dollars using weighted-average exchange

rates. In years when the yen weakens, translating yen into

dollars causes fewer dollars to be reported. When the yen

strengthens, translating yen into dollars causes more dollars

to be reported. The following table summarizes consolidated

cash flows by activity for the years ended December 31.

Operating Activities

The following table summarizes operating cash flows by

source for the years ended December 31.

The increase in Aflac Japan operating cash flows during 2008

was due primarily to the strengthening of the yen against the

U.S. dollar. The decrease in Aflac U.S. operating cash flows was

due primarily to increased U.S. federal tax payments. Cash tax

payments increased in 2008 because we have fully utilized

our remaining tax credit carryforwards. Cash provided by

operating activities was also reduced by the payout of lump-

sum return-of-premium benefits to policyholders on a closed

block of U.S. cancer insurance business. The majority of these

benefit payouts began in 2008 and will conclude in 2012. We

paid out $63 million in 2008, and we anticipate paying out an

additional $360 million over the next four years.

Investing Activities

Operating cash flow is primarily used to purchase debt

securities to meet future policy obligations. The following

table summarizes investing cash flows by source for the years

ended December 31.

The increase in Aflac Japan cash used by investing activities

during 2008 was due primarily to the strengthening of the yen

against the U.S. dollar.

Distribution of Payments by Period

Total Total Less Than One to Four to After

(In millions) *Liability* Payments One Year Three Years Five Years Five Years

Future policy

benefits liability $ 59,310 $ 283,242 $ 8,808 $ 17,103 $ 16,724 $ 240,607

Unpaid policy

claims liability 3,118 3,118 2,318 422 188 190

Long-term debt –

principal 1,713 1,713 450 824 329 110

Long-term debt –

interest 6 64 21 29 7 7

Policyholder

protection

corporation 161 161 31 69 61 –

Operating service

agreements N/A** 674 127 223 174 150

Operating lease

obligations N/A** 173 63 45 24 41

Capitalized lease

obligations 8 8 3 4 1 –

Marketing

commitments N/A** 84 26 58 – –

Total contractual

obligations $ 64,316 $ 289,237 $ 11,847 $ 18,777 $ 17,508 $ 241,105

* Liability amounts are those reported on the consolidated balance sheet as of December 31, 2008.

** Not applicable

Liabilities for unrecognized tax benefits in the amount of $37 million have been excluded from the tabular disclosure above because

the timing of cash payment is not reasonably estimable.

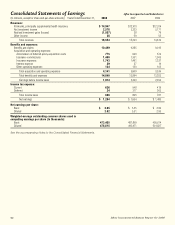

Consolidated Cash Flows by Activity

(In millions) 2008 2007

2006

Operating activities $ 4,965 $ 4,656 $ 4,397

Investing activities (4,283) (3,654) (4,057)

Financing activities (1,383) (655) (434)

Exchange effect on cash and cash equivalents 79 13 –

Net change in cash and cash equivalents $ (622) $ 360 $ (94)

Net Cash Provided by Operating Activities

(In millions)

2008 2007

2006

Aflac Japan $ 4,225 $ 3,573 $ 3,437

Aflac U.S. and other operations 740 1,083 960

Total $ 4,965 $ 4,656 $ 4,397

Net Cash Used by Investing Activities

(In millions)

2008 2007

2006

Aflac Japan $ (3,874) $ (3,231) $ (3,372)

Aflac U.S. and other operations (409) (423) (685)

Total $ (4,283) $ (3,654) $ (4,057)