Aflac 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Aflac Incorporated Annual Report for 2008

Prudent portfolio management dictates that we attempt to

match the duration of our assets with the duration of our

liabilities. Currently, when our debt and perpetual securities

mature, the proceeds may be reinvested at a yield below

that required for the accretion of policy benefit liabilities on

policies issued in earlier years. However, the long-term nature

of our business and our strong cash flows provide us with the

ability to minimize the effect of mismatched durations and/

or yields identified by various asset adequacy analyses. When

market opportunities arise, we dispose of selected debt and

perpetual securities that are available for sale to improve the

duration matching of our assets and liabilities, improve future

investment yields, and/or rebalance our portfolio. As a result,

dispositions before maturity can vary significantly from year to

year. Dispositions before maturity were approximately 4% of

the annual average investment portfolio of debt and perpetual

securities available for sale during the years ended December

31, 2008 and 2007 and 7% during the year ended December

31, 2006. Dispositions before maturity in 2006 were impacted

by the bond swaps we executed in the first half of 2006.

Financing Activities

Consolidated cash used by financing activities was $1.4 billion

in 2008, $655 million in 2007 and $434 million in 2006. In

June 2007, we received $242 million in connection with the

Parent Company’s issuance of yen-denominated Samurai notes,

and we paid $242 million in connection with the maturity of

the 2002 Samurai notes. In June 2006, the Parent Company

paid $355 million in connection with the maturity of the 2001

Samurai notes. In September 2006, the Parent Company

received $382 million from its issuance of yen-denominated

Uridashi notes. Cash returned to shareholders through treasury

stock purchases and dividends was $1.9 billion in 2008,

compared with $979 million in 2007 and $728 million in 2006.

In April 2009, our $450 million senior notes will mature. We

plan to either refinance, subject to market conditions, or use

existing cash to pay off the aforementioned senior notes.

We have no restrictive financial covenants related to our notes

payable. We were in compliance with all of the covenants of

our notes payable at December 31, 2008.

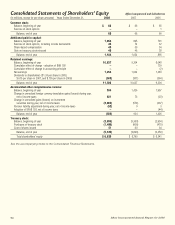

The following tables present a summary of treasury stock

activity during the years ended December 31.

Under share repurchase authorizations from our board of

directors, we purchased 23.2 million shares of our common

stock in 2008, funded with internal capital. The total 23.2

million shares comprised 12.5 million shares purchased

through an affiliate of Merrill Lynch, Pierce, Fenner &

Smith Incorporated (Merrill Lynch) and 10.7 million shares

purchased through Goldman, Sachs & Co. (GS&Co.).

On February 4, 2008, we entered into an agreement for an

accelerated share repurchase (ASR) program with Merrill

Lynch. Under the agreement, we purchased 12.5 million

shares of our outstanding common stock at $60.61 per share

for an initial purchase price of $758 million. The shares were

acquired as a part of previously announced share repurchase

authorizations by our board of directors and are held in

treasury. The ASR program was settled during the second

quarter of 2008, resulting in a purchase price adjustment of

$40 million, or $3.22 per share, paid to Merrill Lynch based

upon the volume-weighted average price of our common

stock during the ASR program period. The total purchase price

for the 12.5 million shares was $798 million, or $63.83 per

share.

On August 26, 2008, we entered into an agreement for a

share repurchase program with GS&Co. Under the agreement,

which had an original termination date of February 18, 2009,

we paid $825 million to GS&Co. for the repurchase of a

variable number of shares of our outstanding common stock

over the stated contract period. On October 2, 2008, due

to market conditions, we took early delivery of 10.7 million

shares, which we hold in treasury, at a total purchase price of

$683 million, or $63.87 per share. We also received unused

funds of $142 million from GS&Co.

As of December 31, 2008, a remaining balance of 32.4 million

shares were available for purchase; 2.4 million shares are the

remainder from a board authorization in 2006 and 30.0 million

shares were authorized by the board of directors for purchase

in January 2008. We do not plan to purchase any shares of our

common stock during the first half of 2009; however, we will

evaluate the market and our capital position to determine if

we will purchase any shares in the second half of the year.

Cash dividends paid in 2008 of $.96 per share increased 20.0%

over 2007. The 2007 dividend paid of $.80 per share increased

45.5% over 2006. The table at the top of the following page

presents the sources of dividends to shareholders for the years

ended December 31.

Treasury Stock Purchased

(In millions of dollars and thousands of shares) 2008 2007

2006

Treasury stock purchases $ 1,490 $ 606 $ 470

Shares purchased:

Open market 23,201 11,073 10,265

Other 146 559 55

Total shares purchased 23,347 11,632 10,320

Treasury Stock Issued

(In millions of dollars and thousands of shares) 2008 2007

2006

Stock issued from treasury $ 32 $ 47 $ 42

Shares issued 2,001 2,723 2,783