Aflac 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

It’s no mystery how Aflac makes a difference.

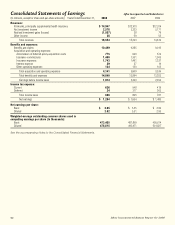

Consolidated Statements of Cash Flows Aflac Incorporated and Subsidiaries

(In millions) Years Ended December 31, 2008 2007 2006

Cash flows from operating activities:

Net earnings $ 1,254 $ 1,634 $ 1,483

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Change in receivables and advance premiums (10) (176) (41)

Increase in deferred policy acquisition costs (462) (454) (474)

Increase in policy liabilities 3,235 3,194 3,304

Change in income tax liabilities (271) 421 180

Realized investment (gains) losses 1,007 (28) (79)

Other, net 212 65 24

Net cash provided by operating activities 4,965 4,656 4,397

Cash flows from investing activities:

Proceeds from investments sold or matured:

Securities available for sale:

Fixed maturities sold 897 1,261 2,358

Fixed maturities matured or called 1,496 1,552 553

Perpetual securities sold 484 194 1

Equity securities sold – – 57

Securities held to maturity:

Fixed maturities matured or called 247 45 172

Perpetual securities matured or called – 140 –

Costs of investments acquired:

Securities available for sale:

Fixed maturities (4,042) (3,848) (4,402)

Securities held to maturity:

Fixed maturities (3,973) (2,920) (2,963)

Cash received as collateral on loaned securities, net 670 (23) 193

Additions to property and equipment, net (49) (46) (23)

Other, net (13) (9) (3)

Net cash used by investing activities (4,283) (3,654) (4,057)

Cash flows from financing activities:

Purchases of treasury stock (1,490) (606) (470)

Proceeds from borrowings – 242 382

Principal payments under debt obligations (5) (247) (377)

Dividends paid to shareholders (434) (373) (258)

Change in investment-type contracts, net 471 210 217

Treasury stock reissued 32 47 42

Other, net 43 72 30

Net cash used by financing activities (1,383) (655) (434)

Effect of exchange rate changes on cash and cash equivalents 79 13 –

Net change in cash and cash equivalents (622) 360 (94)

Cash and cash equivalents, beginning of year 1,563 1,203 1,297

Cash and cash equivalents, end of year $ 941 $ 1,563 $ 1,203

Supplemental disclosures of cash flow information - See Note 14

See the accompanying Notes to the Consolidated Financial Statements.