Aflac 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2Aflac Incorporated Annual Report for 2008

Another Year of Making a Difference

2008 was a year for the history books. As

2008 progressed, it became abundantly clear

that the U.S. economy was on a downward

trajectory. With the housing market rapidly

deteriorating, economic weakness took its

toll on the U.S. consumer. Then the financial

crisis erupted late in the year, which was

both unimaginable and frightening. It’s an

understatement to say that 2008 tested

virtually every company, including Aflac.

Although the global economic downturn

dampened the growth of our new policy

sales last year, we still sold more than 5.5

million policies in the United States and

Japan in 2008, generating more than $2.6

billion of new annualized premium.

A year like 2008 reminds us of why it’s so

important to stay focused on what Aflac

does best. Aflac develops and markets

affordable products consumers need to

help protect them from unexpected health-

related expenses. Furthermore, it is our

duty to invest the premiums we collect to

ensure we will always meet our policyholder

obligations. And it is our goal to operate

efficiently and generate consistent growth

that will reward our shareholders. In the best

or worst of times, our focus hasn’t changed.

Aflac Incorporated Results

Despite the challenges Aflac faced in 2008,

we generated solid financial performance for

the year. Total revenues rose 7.5% to $16.6

billion, reflecting solid growth in premium

income and net investment income, as well

as the benefit of the stronger yen/dollar

exchange rate for the year. Importantly, we

achieved the primary financial objective

we use internally to assess the growth of

our business for the 19th consecutive

year – the growth of net earnings per diluted

share, excluding items that are inherently

either uncontrollable or unpredictable. We

believe this measure best exemplifies our

management and business performance,

and that achieving it is the principal driver of

creating value for our shareholders over the

long term.

Net earnings in 2008 were $1.3 billion, or

$2.62 per diluted share, compared with

$1.6 billion, or $3.31 per share, in 2007.

The decline in net earnings for the year

resulted from sizeable realized investment

losses attributable to the financial crisis. The

realized losses primarily arose from the sale

of our holdings of Lehman Brothers debt,

and the impairments of our investments in

certain perpetual securities, collateralized

debt obligations (CDOs) and other

corporate securities.

Prior to the onset of the financial crisis, we

deployed capital to benefit our shareholders.

We bought 23.2 million of Aflac’s shares in

2008, with the purchases all funded with

internal capital. Since initiating our repurchase

Message from Management

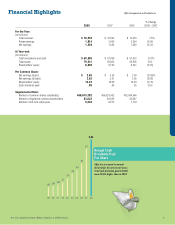

Amounts in 2001 through 2004 have been adjusted to reflect adoption of SFAS 123R on January 1, 2005.

99 00 01 02 03 04 05 06 07 08

Net Earnings Per Diluted Share

Internal Performance Measure

1.04

1.26 1.22

1.49 1.47

2.45

2.922.95

3.31

$2.62

Net Earnings

Per Diluted Share

Net earnings benefited from record

operating results, although realized

investment losses increased sharply

in 2008. Based on the internal

financial measure we use to assess

management’s performance, which

excludes items that are either

outside management’s control

or inherently unpredictable, we

achieved our primary financial

target in 2008.