ADT 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

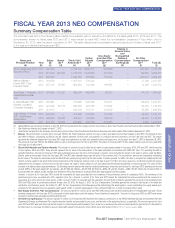

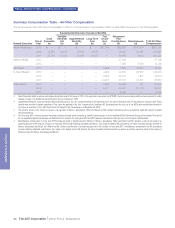

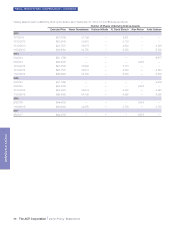

FISCAL YEAR 2013 NEO COMPENSATION—CONTINUED

•Payment of the cost of outplacement services for 12 months

following the termination of employment.

Each NEO must execute a general release of claims in favor of the

Company in order to receive these benefits. The Company will not

reimburse an NEO with respect to any excise tax triggered by

Section 280G or 4999 of the Code, but any Change in Control

payments will be capped at 3 times the NEO’s “base amount” under

Section 280G of the Code if the cap results in a greater after-tax

payment to the NEO than if the payments were not capped.

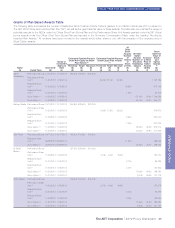

Equity Awards. In addition, the individual award agreements for the

outstanding equity awards provide for special treatment upon

termination of employment, including termination of employment

during the two year period following a Change in Control.

•Awards Granted Prior to October 12, 2011. Other than in the

case of a Change in Control, if an NEO is terminated without

Cause, the NEO will continue to vest in unvested Stock Options

for a period of one year from the date of termination. All other

unvested Stock Options and all unvested RSUs and PSUs will be

forfeited unless the NEO is retirement eligible, in which case all or

a portion of the RSUs or Stock Options will vest and all or a

portion of the PSUs will remain subject to the performance criteria

and may vest upon the achievement of such performance criteria.

With respect to Stock Options, the NEO will have 12 months

following termination to exercise (or, for NEOs that are retirement

eligible, 36 months), subject to the original term of the stock

option.

•Awards Granted On and After October 12, 2011. Other than in

the case of a Change in Control, if an NEO is terminated without

Cause, the portion of Stock Options which would have vested

within one year from the date of termination will immediately vest

upon termination. All other unvested Stock Options and all

unvested RSUs and PSUs will be forfeited unless the NEO is

retirement eligible, in which case the RSUs or Stock Options will

vest pro rata based on the number of full months of service

completed from the date of grant through the termination date,

and all or a portion of the PSUs will remain subject to the

performance criteria and may vest upon the achievement of such

performance criteria. With respect to Stock Options, the NEO will

have 12 months following termination to exercise (or, for NEOs

that are retirement eligible, 36 months), subject to the original term

of the stock option.

•Change in Control. During the two year period following a Change

in Control, if the NEO is terminated without Cause or has a Good

Reason Resignation, all outstanding Stock Options and RSUs

vest in full and all outstanding PSUs vest at the target level. Stock

Options remain exercisable until the earlier of (i) the expiration of

the remainder of their term and (ii) up to three years following the

termination date.

The ADT Corporation 2014 Proxy Statement 41

PROXY STATEMENT