ADT 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172

|

|

FORM 10-K

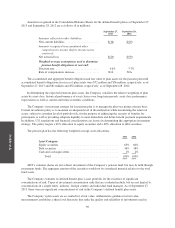

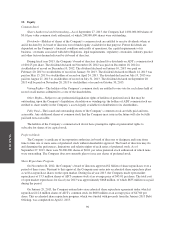

All of the Company’s repurchases were treated as effective retirements of the purchased shares and

therefore reduced reported shares issued and outstanding by the number of shares repurchased. In addition, the

Company recorded the excess of the purchase price over the par value of the common stock as a reduction to

additional paid-in capital.

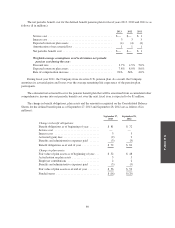

Accumulated Other Comprehensive Income

The components of accumulated other comprehensive income reflected on the Consolidated Balance Sheets

are as follows ($ in millions):

Currency

Translation

Adjustments

Deferred

Pension

Losses(1)

Accumulated

Other

Comprehensive

Income

Balance as of September 24, 2010 $ 97 $(18) $79

Pre-tax current period change ............ 3 (5) (2)

Income tax benefit ..................... — 2 2

Balance as of September 30, 2011 100 (21) 79

Pre-tax current period change ............ 17 (5) 12

Income tax benefit ..................... — 2 2

Balance as of September 28, 2012 117 (24) 93

Pre-tax current period change ............ (19) 10 (9)

Income tax benefit ..................... — (4) (4)

Balance as of September 27, 2013 $ 98 $(18) $80

(1) The balances of deferred pension losses as of September 27, 2013, September 28, 2012 and September 30,

2011 are reflected net of tax benefit of $11 million, $15 million and $13 million, respectively.

Other

During fiscal year 2013, the Company made adjustments to additional paid-in capital, which primarily

resulted from the receipt of $61 million in cash from Tyco and Pentair related to the allocation of funds in

accordance with the 2012 Separation and Distribution Agreement.

97