ADT 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

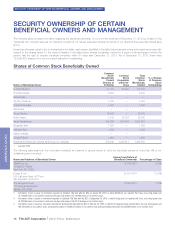

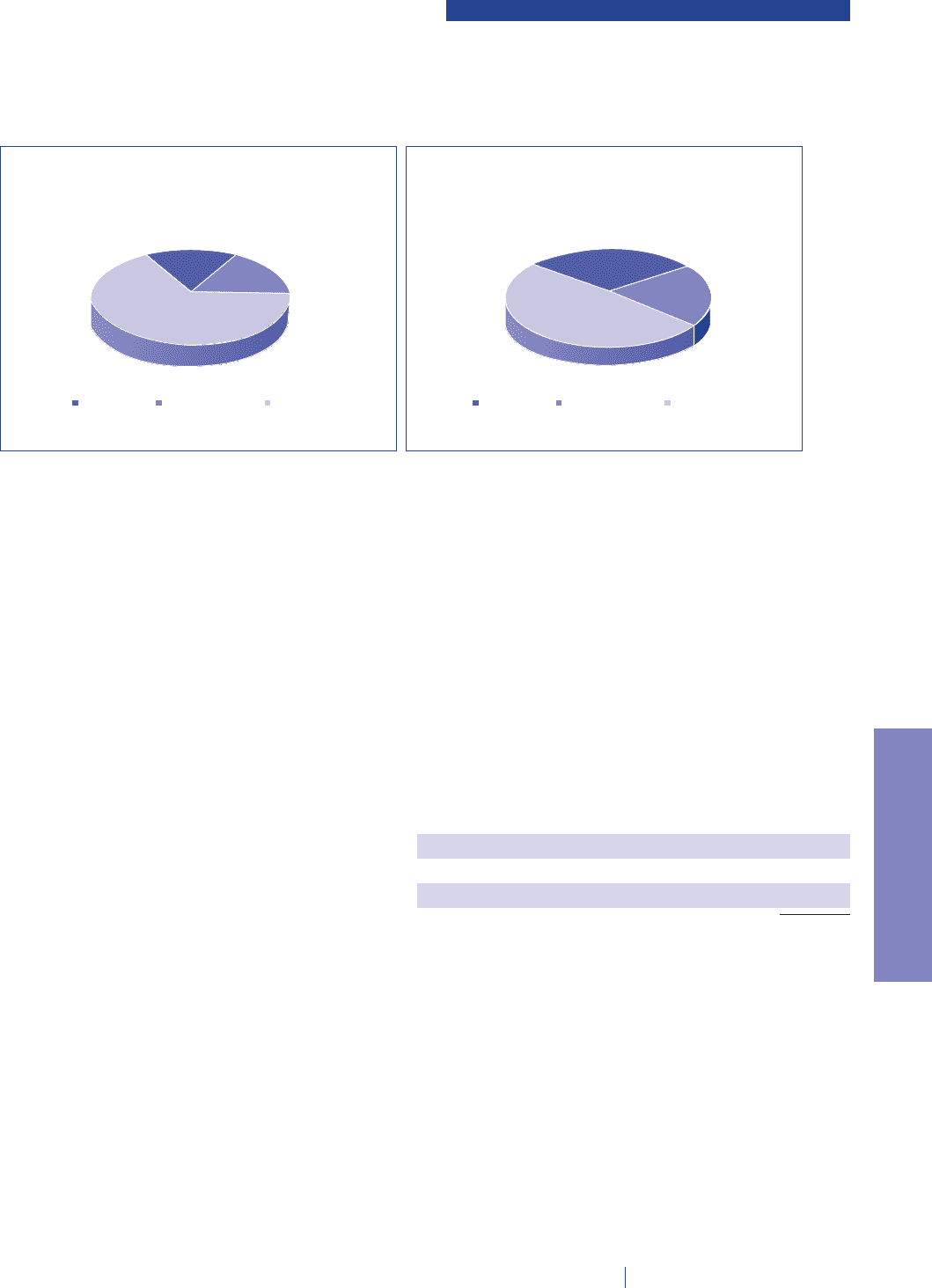

The chart below, which summarizes the distribution of targeted total

direct pay for our NEOs in fiscal year 2013, highlights that over 80%

of CEO target annual compensation and, on average, nearly 70% of

other NEO target annual compensation, is variable with performance,

including stock price performance.

CEO Other NEOs

Base Salary Annual Incentive Long-Term Incentives Base Salary

66%

17%

17%

Annual Incentive Long-Term Incentives

49%

20%

31%

Fiscal Year 2013 Compensation and

Decisions

In fiscal year 2013, we made a number of decisions regarding the

design of our compensation programs, as well as specific decisions

regarding the compensation of several of our Executive Officers.

Although our initial compensation programs generally were based on

the compensation programs designed by Tyco when the Company

operated as a Tyco subsidiary, we established our programs

following our separation from Tyco to reflect our focus as a

subscriber-based business with significant recurring monthly revenue.

Among the changes we made were:

•The introduction of a Recurring Revenue Growth measure to the

Company’s Annual Incentive Plan (“AIP”) to support our strategy to

increase revenues through both net customer additions and

increased Average Revenue Per User (“ARPU”);

•Increased the weighting of Net Attrition in the AIP to reflect the

importance of maintaining and growing our customer base;

•Added a Strategic Modifier to focus on selected strategic

initiatives to drive profitable growth. We chose to focus on

increasing the Pulse Take Rate and on growing our Small

Business unit recurring revenues; and

•The modification of the Company’s Long-Term Incentive Plan

(“LTIP”) with the focus on growing the business and generating

increased cash flows by utilizing Recurring Revenue Growth and

Adjusted Free Cash Flow Growth metrics.

In addition to the changes we made in our compensation programs,

we made specific individual compensation decisions in fiscal year

2013 for certain of our NEOs to reflect their assumption of additional

responsibilities:

•Mr. Gursahaney’s base salary increased by 48% to reflect his new

role as CEO. Mr. Gursahaney’s annual incentive target remained

at 100% of base salary, resulting in a corresponding increase to

his annual incentive target. Prior to his appointment as CEO upon

the Company’s separation from Tyco, Mr. Gursahaney served as

President of Tyco Security Solutions.

•Mr. Bleisch and Ms. Graham received an increase in base salary

(which resulted in a corresponding increase in annual incentive

target) of 19% and 8%, respectively, in recognition of their new

roles in the stand-alone public company. In August 2013,

Mr. Bleisch received an additional 10% increase in base salary

(which resulted in a corresponding increase in annual incentive

target) based upon a review of his compensation in relation to

similarly situated roles in the broader market. Prior to their

appointments to their respective positions upon the Company’s

separation from Tyco, Mr. Bleisch served as General Counsel and

Ms. Graham served as Vice President of Human Resources, each

of Tyco Security Solutions.

We also made several key executive hires during fiscal year 2013 in

order to better position the Company for future success, among them

Alan Ferber, the President of our Residential Business unit and one of

our NEOs. In addition, subsequent to the end of the fiscal year, we

hired Michael Geltzeiler as our Chief Financial Officer. Mr. Geltzeiler’s

target compensation for fiscal year 2014 is as follows:

Base Salary $ 750,000

Annual Incentive Target $ 750,000

Target Long-Term Incentive Award $1,875,000

Total $3,375,000

Pay for Performance

We strongly believe that a significant portion of our executives’

compensation opportunity should be fulfilled only when supported by

our performance. Currently, all of our executives’ annual incentive

compensation and a portion of their long-term equity incentive

compensation is payable only if we attain certain specified goals

(including, for our NEOs other than the CEO, certain individual

objectives included as part of our annual incentive program), thereby

placing a substantial portion of executive compensation at risk. The

remainder of our executives’ long-term equity incentive compensation

is awarded in stock options and time-vested restricted stock units,

the value of each of which is dependent on our performance over an

extended vesting period. This pay element is designed to create

The ADT Corporation 2014 Proxy Statement 23

PROXY STATEMENT